KMLM: The Managed Futures ETF Playbook

Please register to download this report

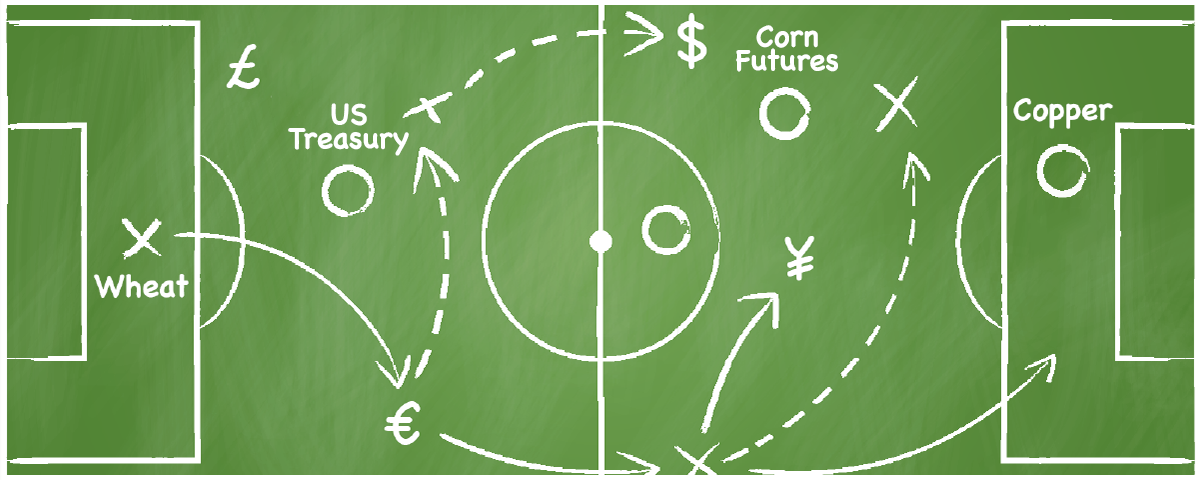

Following a banner year for Managed Futures Strategies in 2022, investor interest in the space is surging. Due to this renewed focus, we believe investors should understand how these strategies work and what sets the KFA Mount Lucas Managed Futures Index Strategy ETF (ticker: KMLM) apart from its peers.

The following report provides an overview of KMLM’s components and mechanics and how they worked together to provide KMLM’s 30% return in 2022 when major equity and fixed income indexes suffered. We will also discuss the different factors that drive Managed Futures manager returns in general. This strategy allows KMLM to adapt to unpredictable macro-level market events and makes it what we believe to be one of the most versatile tools investors can have in their portfolios.

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.