KMLM Achieves a Three-Year Track Record, Continues to Provide Consistent Uncorrelated Returns

Introduction

KraneShares and Mount Lucas Management are pleased to announce that the KFA Mount Lucas Managed Futures Index ETF (Ticker: KMLM) achieved a three-year track record in December 2023. This anniversary marks a significant milestone for the fund, which has delivered consistent uncorrelated returns since its inception.

In recent years, managed futures strategies have grown in popularity for their diversification benefits during periods of uncertainty.* These benefits were especially pronounced in 2022 when equities declined -18.13% and bonds fell -13.01%, but managed futures, as measured by KMLM, rose +30.52%.1

For the three years since KMLM's inception, the fund returned +41.84% versus equities +31.25% and bonds -11.88%.1

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.

As investors position their portfolios for 2024, uncertainty in the markets persists, especially regarding the narrow rally in equities and the unclear direction of interest rates. As more and more investors turn to managed futures for their risk mitigation potential, we believe KMLM stands out amongst its peers.

KMLM Based on a 35-Year Pedigree in Managed Futures Investing

KMLM tracks the KFA MLM Index, which is a continuation of Mount Lucas Management's famed MLM Index,™ adapted specifically for use by KMLM. The MLM Index™ was first published in 1988 to measure the returns from investing passively in a basket of futures contracts, both long and short.

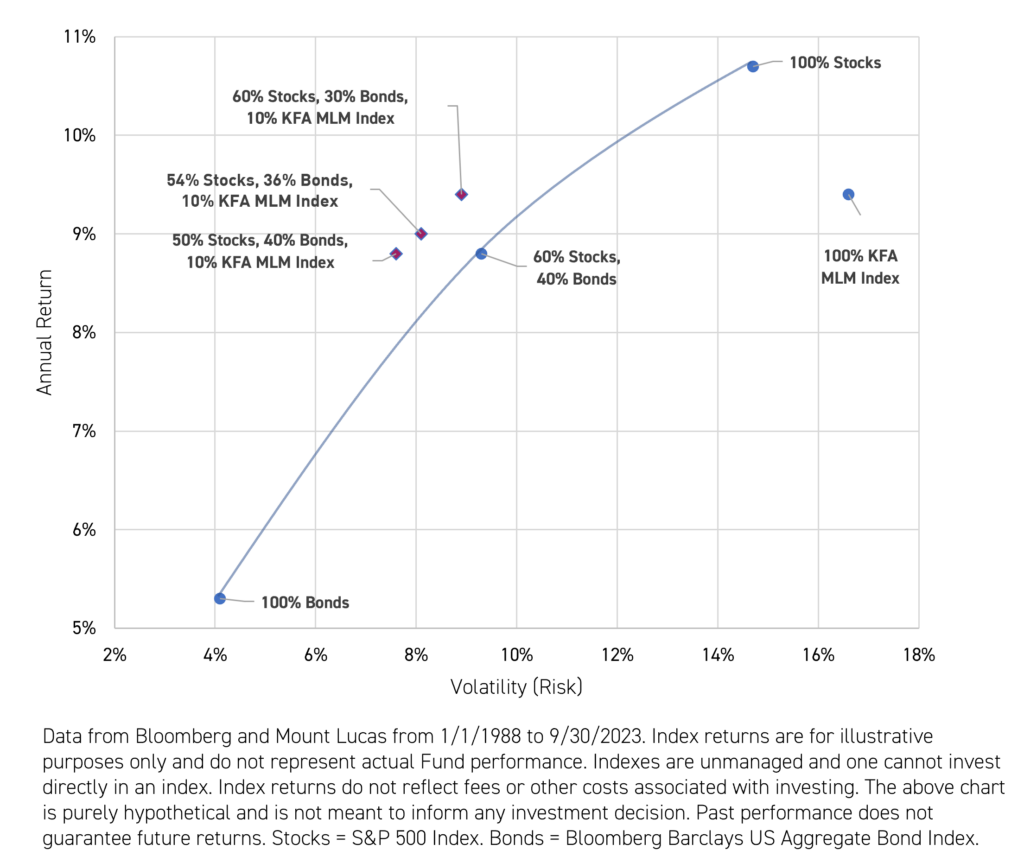

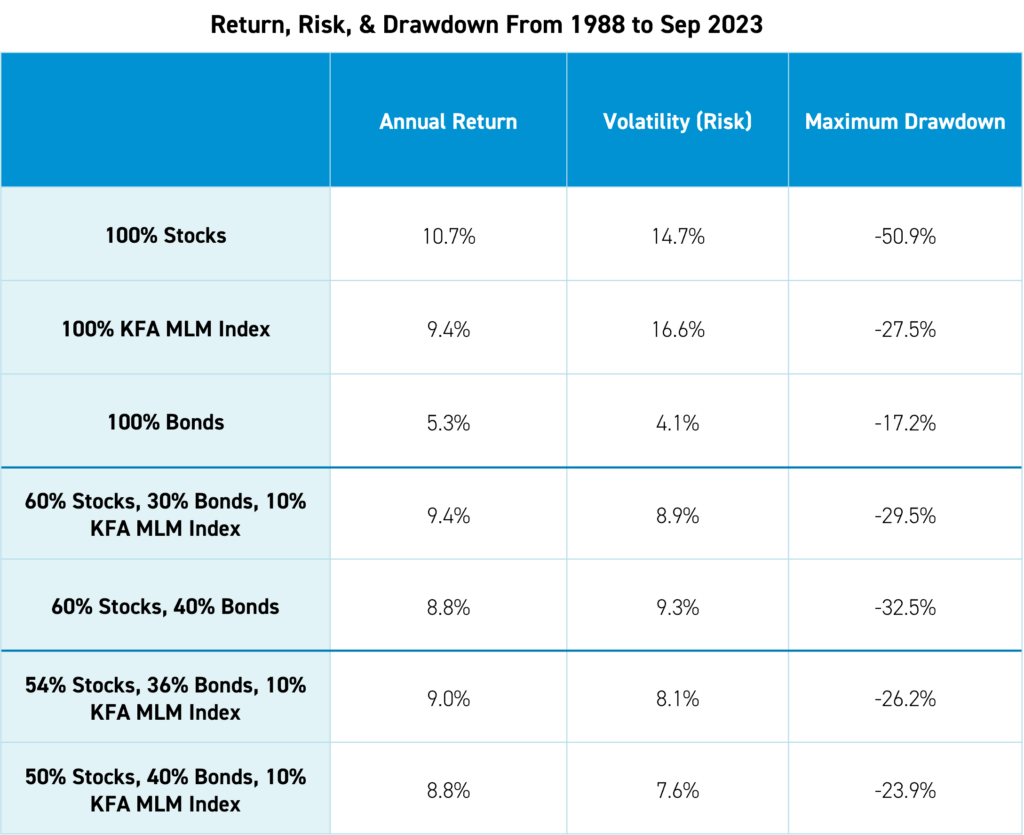

Today, the KFA MLM Index allows investors to analyze over thirty-five years of live index history. This data shows that including managed futures within an investment portfolio can reduce risk and drawdown when used as a complement to a traditional 60% stock and 40% bond portfolio. Allocating as little as 10% to managed futures can produce significant risk-adjusted performance benefits.

The Advantages of an Index-Based Approach to Managed Futures

Managed Futures have long been the domain of active managers; however, we believe there are many potential advantages to an index-based approach over an active approach. Namely, indexes are not subject to portfolio manager biases and are typically more cost-effective. When incorporating managed futures into a portfolio of stocks and bonds, one of the challenges is understanding the return stream these investments generate. What detracted or added to performance? How much of that was attributable to manager skill?

We believe KMLM’s rules-based index approach allows investors to easily see how returns are generated in the space.

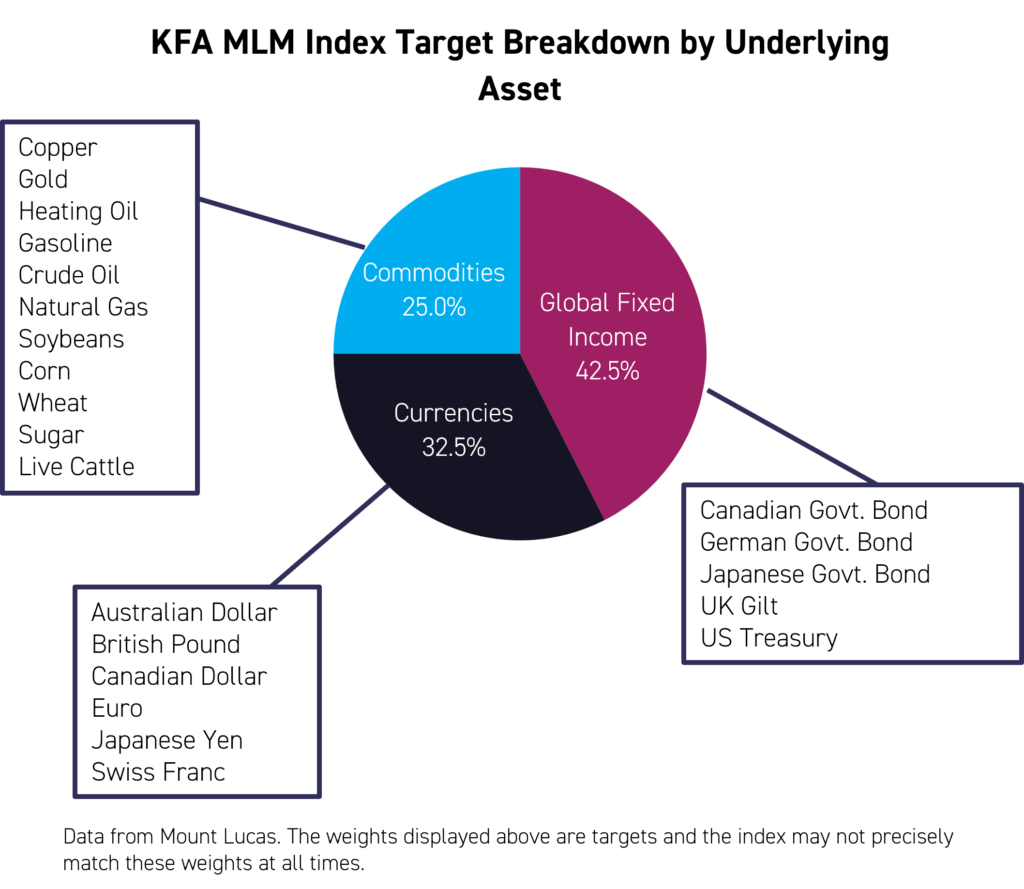

The KFA MLM Index consists of a portfolio of twenty-two liquid futures contracts traded on U.S. and foreign exchanges. The Index includes futures contracts on 11 commodities, 6 currencies, and 5 global bond markets and does not include any equity exposure.

These commodity, currency, and bond market baskets are weighted by their relative historical volatility. Within each basket, the constituent markets are equal dollar weighted. A daily trend signal is generated based on each market’s price versus its long-term moving average. Signals can be long or short.

Conclusion

KMLM stands as a testament to the effectiveness of a managed futures strategy. With an impressive three-year track record, Mount Lucas Management's seasoned approach, and pattern of performance, KMLM provides investors with a level of transparency and risk-adjusted performance that sets it apart from its peers.

About Mount Lucas Management

Mount Lucas Management, the sub-advisor of KMLM, is a Pennsylvania-based asset manager founded in 1986. Since its founding, Mount Lucas has provided innovative alternative investment strategies to institutional and high-net-worth investors that enhance and diversify traditional investments.* In 1988, Mount Lucas Management introduced the MLM Index™ as the first passive trend-following Index. They have been tracking the index in client accounts since 1993.

About KraneShares

KraneShares is a specialist investment manager focused on China, climate, and uncorrelated assets. KraneShares seeks to provide innovative, high-conviction, and first-to-market strategies based on the firm and its partners' deep investing knowledge. KraneShares identifies and delivers groundbreaking capital market opportunities and believes investors should have cost-effective and transparent tools for attaining exposure to a wide variety of asset classes. The firm was founded in 2013 and currently serves institutions and financial professionals globally. The firm is a signatory of the United Nations-supported Principles for Responsible Investing (UN PRI).

*Diversification does not ensure a profit or guarantee against a loss.

Citation

- Equities are measured by the S&P 500 Index, and bonds are measured by the Bloomberg Barclays US Aggregate Bond Total Return Index. Data retrieved from Bloomberg as of 12/12/2023. KMLM's inception was December 2, 2020.

Index Definitions

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

KFA MLM Index (“KMLM’s Index”): The KFA MLM Index is a diversified trend-following portfolio of commodity, currency, and global fixed-income futures contracts traded on US and foreign exchanges. The performance data for the index is a representation of the MLM Index™ from 1/1/1988 to 12/31/2004, the MLM Index EV (“EV”), with enhanced Execution and Volatility characteristics, from 1/1/2005 to 11/30/2020, and, using the same methodology as the “EV,” the KFA MLM Index from 12/1/2020 on.

Bloomberg Barclays US Aggregate Bond Total Return Index (“US Aggregate Bond Index”: Bloomberg Barclays US Aggregate Bond Index: The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate, taxable bond market in the United States. The index includes Treasuries, government-related, and corporate securities. The index was launched on January 1, 1976.