KMLM & Managed Futures FAQ

What are managed futures?

Futures markets were created over 150 years ago for a single purpose, to facilitate the transfer of price risk away from producers and consumers. A managed futures portfolio acts as an important market participant, accepting that price risk and providing liquidity to commercial interests. Futures markets are traded on public exchanges and are based on standardized futures contracts in equities, bonds, currencies, and commodities.

What are the benefits of investing in managed futures?

The primary benefit of investing in managed futures is the mitigation of portfolio risk through an uncorrelated asset class. During periods of market stress, managed futures have historically shown greater potential for negative correlations. Institutional investors may employ an active futures manager for a variety of reasons. However, investors of all types may use managed futures to diversify risks in a portfolio that does not already consist of derivatives.*

Can you describe the index the fund tracks?

The MLM Index, a patented, widely recognized benchmark, was created by Timothy Rudderow (CEO/CIO, Mt. Lucas Management) in 1988 as a means for evaluating futures investments that are actively managed. The index includes futures contracts on 11 commodities, 6 currencies, and 5 global bond markets. These three baskets are weighted by their relative historical volatility, and within each basket, the constituent markets are equal dollar weighted. A daily trend signal is generated based on each market’s price versus its long-term moving average. Signals can be long or short. Rebalances occur on the first of the month, and futures contracts are rolled forward market-by-market. The index committee will review the twenty-two constituents to determine additions and deletions based on liquidity and market volume.

Can you provide the KFA MLM Index returns going back to 1988?

The latest KFA MLM Index history is available in excel or CSV format upon request. Email [email protected] to receive the file. Also, the KMLM Investor deck includes monthly index data as of the most recent calendar quarter-end dating back to 1988.

The ETF is described as passive but dynamic. What does this mean?

Passive ETF means it tracks an index, in this case, the KFA MLM Index. This is completely rule-based, and offers full transparency compared to some of the other active managers in this space. At the same time, it is dynamic due to its’ long-short nature, this means it has the ability to switch exposures depending on the market environments, helping investors navigate the market, especially in times of heightened volatility.

Does KMLM issue a K-1 or 1099 for tax reporting purposes?

KMLM does not issue a K-1. KMLM shareholders will receive a 1099 form. Investors should consult their tax advisors for professional advice.

Can you provide the rationale for why equity futures are excluded?

Managed futures are best viewed through the lens of a portfolio element, typically something that diversifies against an equity portfolio. Having equities in your managed futures portfolio muddies this diversification benefit.* Trend following equities does work and typically improves the overall risk-adjusted performance of the managed futures portfolio, but what is suitable for the manager is not always good for the client portfolio. This is particularly a problem in managed futures strategies that target volatility, which creates a natural equity bull bias in managed futures. Mt. Lucas published a blog on this concept here: https://blog.mtlucas.com/2018/12/21/equity-bull-bias-in-volatility-targeting/

Can you provide net exposures by category (commodities) and sub-categories over time?

Historical exposure data is available upon request. Please email [email protected] for this data.

Does the index have an explicit volatility target?

The KFA MLM Index sets an explicit asset allocation/exposure to trend following Commodities, Currencies, and Fixed Income. Based on that asset allocation, we expect the index to run at an annualized volatility of around 15% over a full market cycle, roughly the same as US equities.1 If the underlying markets are more volatile than average, index volatility will run higher; if they are less volatile than average, index volatility will run lower. We believe this approach creates better diversification and positive skew in volatile periods (which are good environments for managed futures and typically the worst for equities).*

Why is there a performance discrepancy between KMLM and its index?

The KMLM ETF performance is net of fees. The performance for the KFA MLM Index is based on a historical index and is gross of any fees and expenses. In general, there will be slippage of 90bps per year plus around 15bps per year of trading expenses (broker commissions). Any slippage above that is attributable to execution and cash management.

A note on tracking error: In October 2022, we switched from using SCHO ETF (1-3yr govt bonds) for excess cash management to a laddered T-Bill portfolio. The KFA MLM Index we track assumes a cash return of 30-day T-Bills on 100% of the assets. For the ETF, typically 15%-20% of assets are at the futures broker earning interest, but earn less than the 30-day T-Bill. The remaining 80%-85% of excess cash is at the custodian invested in a laddered T-Bill portfolio with maturities up to 1yr (prior to October 2022 it was SCHO). Assuming a normal yield curve, having maturities out further on curve helps make up difference to the broker’s level of paid interest. Most of the slippage from 2022 is attributable to the cash investment in SCHO plus typical fees. There was some additional drag on the cash piece in 2023 with rising rates and the inverted yield curve, but far smaller relative to the effect SCHO had in 2022.

Moving forward, we anticipate the laddered T-Bill approach will provide much less volatility in tracking the cash return target than facing the additional duration risk that existed in SCHO.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Indexes are unmanaged and one cannot invest directly in an index. Index returns do not reflect fees or other costs associated with investing.

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.

Will the MLM index add cryptocurrencies to its exposures?

While there are now two cryptocurrency futures markets, Bitcoin and Ethereum, they are not included in the MLM Index at this time. Mount Lucas believes the crypto futures markets need to mature more before they can be added. Investors can earn a premium in the futures markets when commercial entities face real price risks that they need to transfer to investors. Presently, cryptocurrencies need to be more heavily used by companies and commercial entities so that they feel compelled to hedge their exposure to the price of bitcoin as they would heating oil or other traditional commodities. If crypto becomes a more integral part of the economy with more widespread business applications, it could be eligible for inclusion in the MLM Index.

What are the advantages of owning managed futures in an ETF versus in separately managed accounts (SMAs) or other vehicles?

Historically, gaining managed futures exposure has often involved complex, expensive, and tax-inefficient vehicles such as private funds that were only accessible to large institutions and ultra-wealthy individuals. KMLM represents an evolution in the democratization of managed futures, providing efficient and low-cost exposure to managed futures that is available to all investors.

What makes KMLM different than other managed futures strategies?

The MLM Index has a passive, rules-based, and transparent methodology with over 30 years of live track record dating back to 1988. Over this time frame, the MLM Index has proven to have a negative correlation during periods of market stress, including the Global Financial Crisis of 2008 and, more recently, the COVID Crash of 2020.

Other managed futures ETFs utilize hedge fund replication strategies, attempting to recreate the largest hedge fund performance by dissecting their principal components and positioning accordingly. Hedge fund replication strategies can be complicated, opaque, and inconsistent. Additionally, since they can hold significant equity exposures, they may have diminished negative correlation benefits during periods of crisis compared to KMLM.

What is the best way to incorporate this into an existing portfolio?

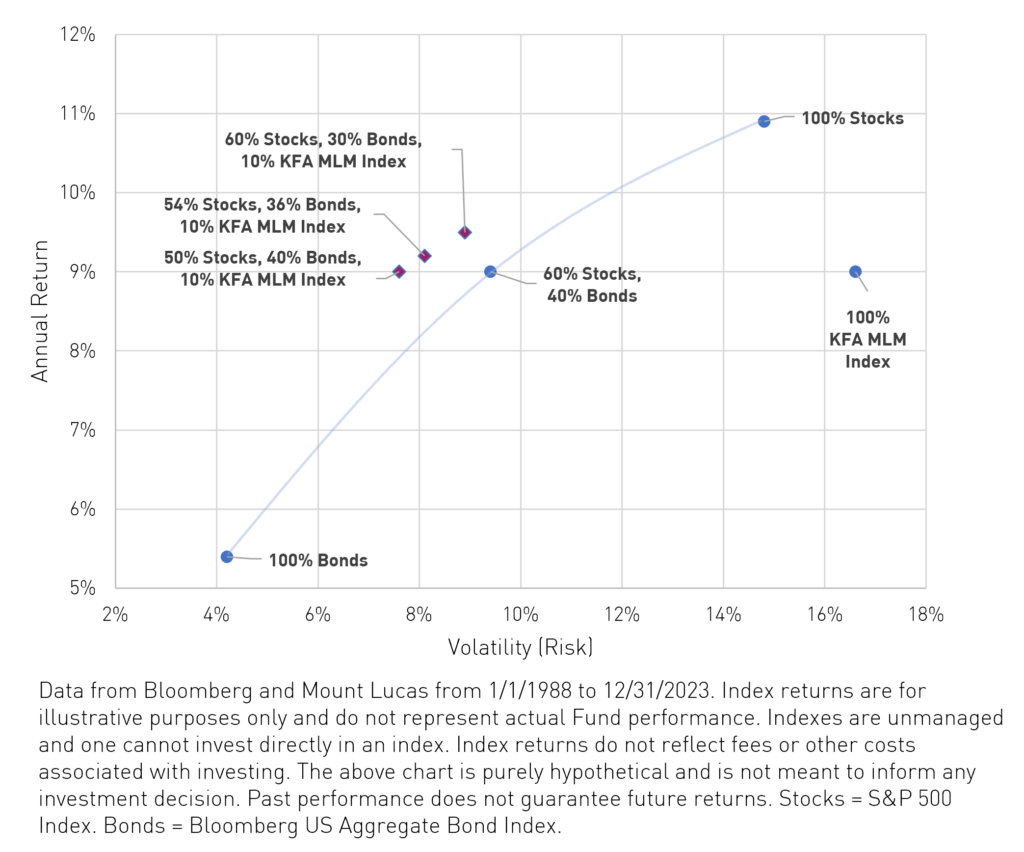

There is no one singular best way to incorporate this into a portfolio as every client’s circumstance is different. Broadly speaking, we believe a 5%-10% allocation can be appropriate in a traditional 60/40 asset allocation. In the illustrated example, we’ve taken 10% from the lower-risk bond portion of the 60/40 portfolio and put it into KMLM, the result is increased annual return, lowered overall volatility, and lowered maximum drawdown.

*Diversification does not ensure a profit or guarantee against a loss.

Term Definitions

Volatility: the degree of variation of a trading price series over time as measured by the standard deviation of returns. Standard deviation is a quantity calculated to indicate the extent of deviation for a group. A low standard deviation indicates that the data points tend to be close to the set's mean (also called the expected value). In contrast, a high standard deviation indicates that the data points are spread over a wider range of values.

Skew: is a statistical measure of how returns behave in the tails of a probability distribution. If an investment (e.g., stocks) has negative skewness, the extreme returns are more likely to be negative than positive (it tends to crash). However, if its return has a positive skew (e.g., buying a call option on stocks), then its large returns are more likely to be positive than negative.

Citation

1.) Data from Bloomberg as of 9/30/2022