KMLM: Strong Commodity Returns Drive Performance in Q3

Index and Sector Performance

The KFA MLM Index, which is tracked by the KFA Mount Lucas Managed Futures Index Strategy ETF (Ticker: KMLM), finished the quarter up 6.8%. Global Fixed Income (+3.3%) and Commodity (3.2%) markets contributed positively to performance, while Currency (-1.1%) markets detracted. Interest income added 133bps. For the twelve months ending September 2023, the Index was down 2.6%. Year to date, the Index is up 7.0%.

Index and Sector Exposures

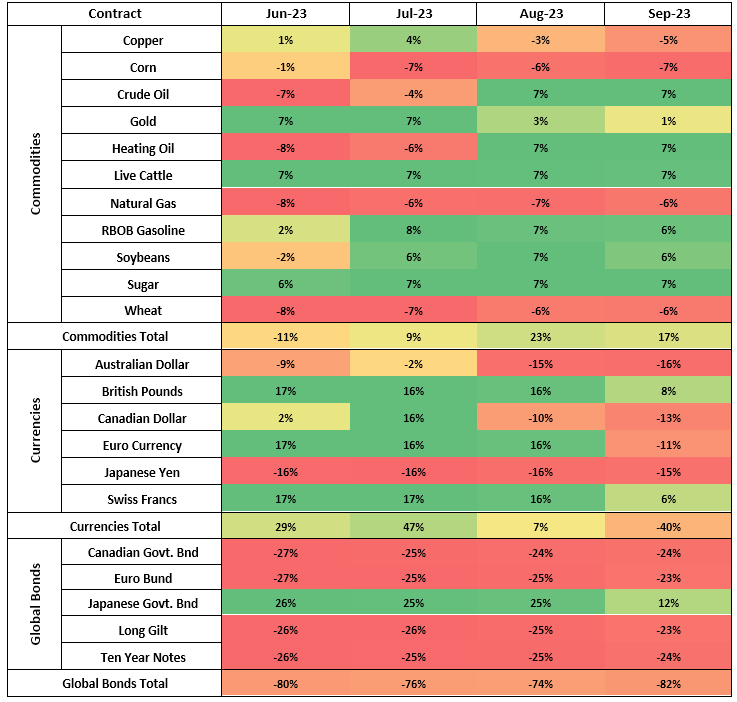

Over the course of the quarter, Commodity exposures went from net short 11% to net long 17%, Currency exposures went from net long 29% to net short 40%, and Global Fixed Income exposures went from net short 80% to net short 82%.

Outlook

In the Commodity sector, the top three contributors were Wheat, Natural Gas, and Sugar. The bottom three contributors were Heating Oil, Soybeans, and Crude Oil. Performance in the sector was decently positive as long trending shorts in Wheat, Natural Gas, and Corn and a strong positive trend in Sugar drove results. Both Crude Oil and Heating Oil struggled early in the quarter while they transitioned from short to long as prices rallied, each posting positive gains in the final two months. After a summer rally in Soybeans, prices fell at the end of the quarter as fundamentals improved (supply okay, demand weak). In metals, Copper was range-bound over the quarter, finishing near lows, while Gold sold off rapidly toward the end of the quarter. Both Live Cattle and Sugar are just off their recent highs in agricultural markets. The major shifts in exposure during the quarter came in Copper (long to short), Gold (decreased long), Corn (increased short), Soybeans (short to long), Crude Oil (short to long), Heating Oil (short to long), and Unleaded Gas (increased long).

In the Currency sector, the top contributor was the Japanese Yen, and the top detractors British Pound, Euro Currency, and Swiss Franc. The Dollar has marched straight up from lows in the middle of July through September, keeping with the macro theme of rates remaining higher for longer and relative to other G7 countries. The long positions in British Pound, Euro Currency, and Swiss Franc took the brunt of this move. The short position in the Japanese Yen profited from the move, helping to offset losses. The major shifts in exposure during the quarter came in Australian Dollar (increased short), British Pound (decreased long), Canadian Dollar (long to short), Euro Currency (long to short), and Swiss Franc (decreased long).

In the Global fixed-income sector, the short positions in the Canadian Government Bond, Euro Bund, UK Long Gilt, and U.S. Ten Year Note were the top contributors, with only the long position in the Japanese Government Bond detracting. Broadly speaking, bond prices remain near their lows and struggling to find a bid as recessionary fears abate. The major shifts in exposure during the quarter came in the Japanese Government Bond (decreased long).

Net Market Exposures

Holdings are subject to change.

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.