KMLM: Commodity Positioning Fuels Q1 Performance, With No Equity Overlap

Index and Sector Performance

The KFA MLM Index, which is tracked by the KFA Mount Lucas Managed Futures Index Strategy ETF (Ticker: KMLM), finished the quarter up 4.0%. Commodity (+3.9%) and Currency (+0.3%) markets contributed to performance, while Global Fixed Income (-1.5%) markets detracted from results. Interest income added 134bps. For the twelve months ending March 2024, the Index was up 1.9%. Year to date, the Index is up 4.0%.

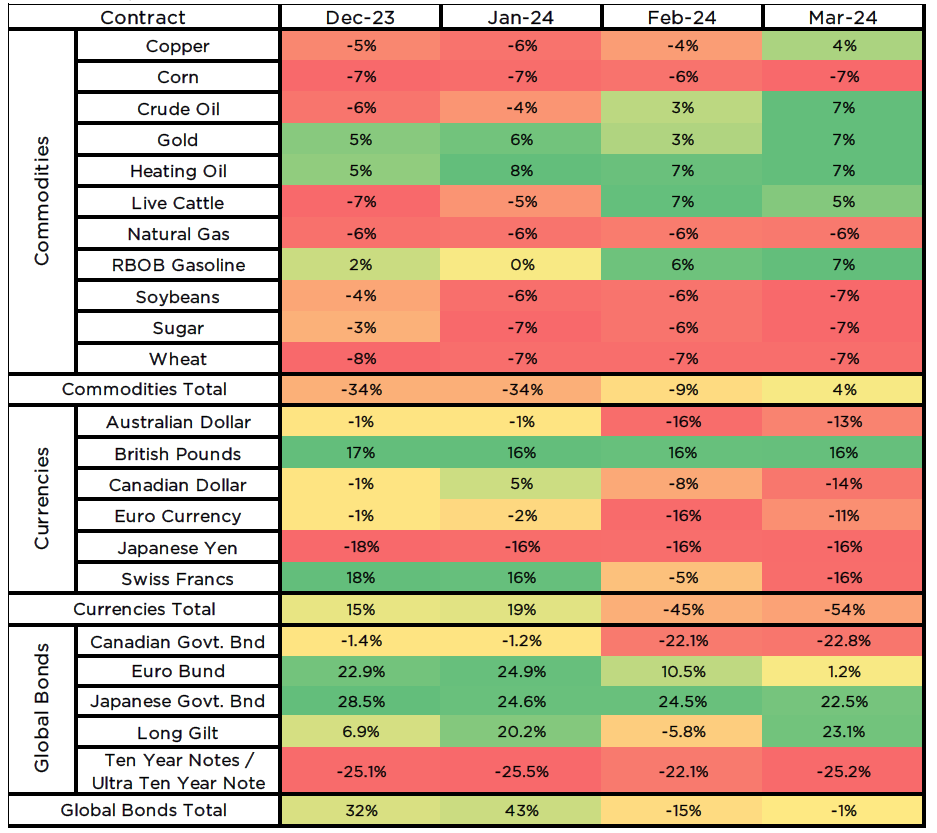

Index and Sector Exposures

Over the course of the quarter, Commodity exposures went from net short 34% to net long 4%, Currency exposures went from net long 15% to net short 54%, and Global Fixed Income exposures went from net long 32% to net short 1%.

Outlook

Not only was it a good quarter for the Index, but the active managers in the space had a “very” good quarter. A distinguishing feature of the Index is that it provides pure trend results and does not invest in equity index futures. The benefit is access to higher skew in stress periods and better diversification in the investor portfolio when combined with traditional asset allocations.* The downside, or cost, is access to equity returns in both direction and size in ripping equity markets. Managed Futures managers that included equity were able to get long via trend toward the beginning of December, and those that were volatility scaling positions increased exposures significantly through the end of the first quarter.

Good result, but investors should be conscious that if they use Managed Futures for diversification, they own a lot more equity right now. The Index takes the hard road, prioritizing diversification potential by avoiding equity markets and letting profits ride during volatile stress periods.*

Read our article Why No Equities in KMLM Managed Futures ETF? to learn more about why the Index doesn’t have exposure to equities.

In the Commodity sector, top contributors were short Natural Gas, short grain markets, and long Heating Oil and Unleaded Gas. The bottom three contributors were Sugar, Live Cattle, and Copper. In the grain markets, Corn, Soybeans, and Wheat all finished near their lows for the quarter, benefiting the short positions. In metals, Copper rallied toward the end of the quarter, hurting the short position and ultimately pushing the Index into a long position. Gold rallied sharply as well to new highs. In energy, Natural Gas finished the quarter at its lows, but Crude Oil, Heating Oil, and Unleaded Gas all saw a bumpy uptrend throughout the quarter. In soft commodities, like juice, cocoa, and meats, there were mid-quarter price rallies in sugar and live cattle, and both sold off towards month-end. The major shifts in exposure during the quarter came in Copper (short to long), Crude Oil (short to long), Gold (increased long), Heating Oil (increased long), Live Cattle (short to long), Sugar (increased short), Unleaded Gas (increased long).

In the Currency sector, the top contributor was short Japanese Yen, and the top detractors were the Swiss Franc, Australian Dollar, and British Pound. After the trend reversals of the previous quarter, most major currencies settled into a trading range during Q1. The two exceptions were the Japanese Yen and Swiss Franc, which reversed last quarter’s rally and made new lows. The Index profited from the move in Yen but was not positioned for the reversal of the Swiss Franc. The major shifts in exposure during the quarter came in Australian Dollar (almost flat to short), Canadian Dollar (almost flat to short), Euro Currency (almost flat to short), and Swiss Franc (long to short).

In the Global Fixed Income sector, the short position in Ultra Ten Year was the only contributor, with Euro Bund, UK Long Gilt, and Canadian Government Bonds detracting. Similar to Currency markets, the bond price rally that ended Q4 reversed slightly in Q1 as the market accepted the reality that rate cuts would be pushed down the road a bit. The major shifts in exposure during the quarter came in the Canadian Government Bond (almost flat to short), Euro Bund (long to nearly flat), and Long Gilt (increased long).

Net Market Exposures

Holdings are subject to change.

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index returns do not reflect management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

*Diversification does not ensure a profit or guarantee against a loss.