Managed Futures: A Time Tested Approach to Volatile Markets

The last few months have been an excellent case for the role of managed futures in a portfolio. Managed futures have the potential to do well in periods of macro volatility, and this time is no different.

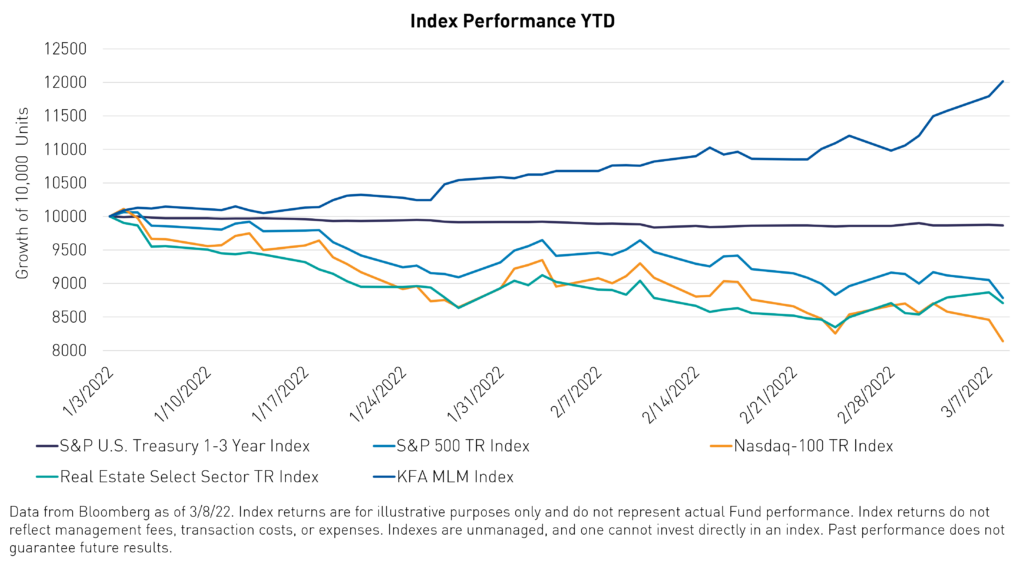

With concerns around rising interest rates and now geopolitical tensions, 2022 has started rocky for many investors. Look across the investment landscape; which asset classes have done well this year? Short-term treasuries? Nope. The S&P U.S. Treasury 1-3 Year Index is down 1.4% YTD1. Stocks? Nope, the S&P 500 TR Index is down 12.3%, and the Nasdaq-100 TR Index is down 18.6%1. Real Estate? The Real Estate Select Sector TR Index is down 12.3% YTD1. Some of the tail risk and long volatility strategies were also down.

How about managed futures? The KFA MLM Index is up 22.9% YTD1 while major sectors are all down. The index includes futures contracts on 11 commodities, 6 currencies, and 5 global bond markets and is designed as a potential hedge on equity, bond, and commodity risk.

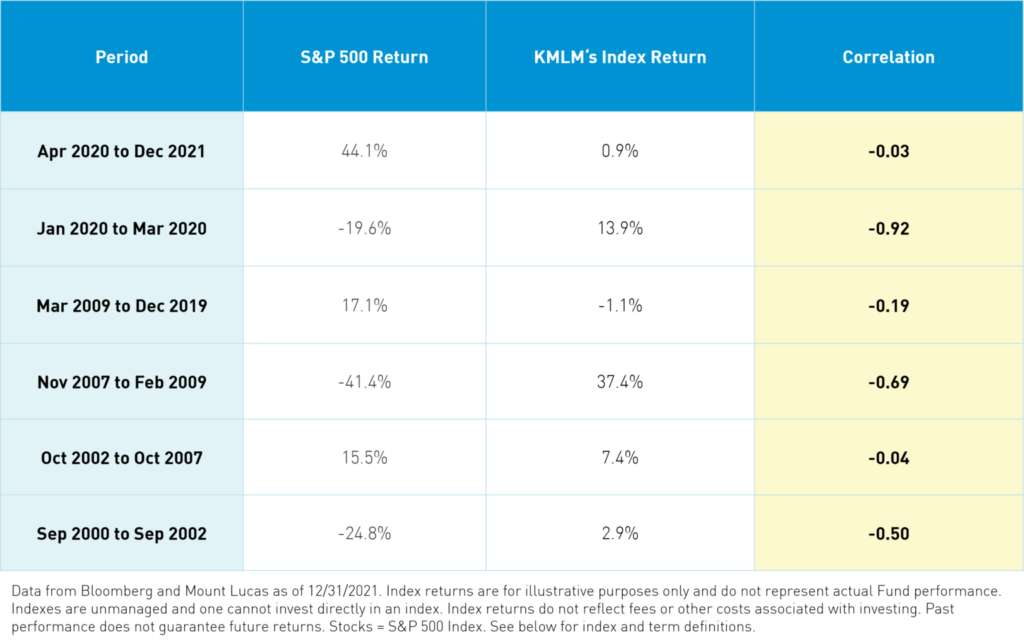

These performance characteristics are not a one-off phenomenon. Mt. Lucas Management established the first passive index to measure the returns to risk-bearing in the futures market in 1988. Over the past thirty years, the KFA MLM Index has exhibited negative correlations with US equity and bond markets during bull (rising) and bear (declining) market periods.

So why is it that managed futures have not gained wider acceptance as a portfolio element?

Investors are generally comfortable viewing the market through the lens of stocks. Equity markets tend to do well when the economy is growing steadily, and inflation and interest rates are tame. Equities tend to struggle in times of uncertainty when volatility is high, and stress is everywhere (negative skew). During these periods of market volatility investors may want an additional element of diversification* in their traditional portfolio of stocks and bonds.

It’s during those periods when equity markets are rising, the economy is growing, inflation is tame, that investors may question their exposure to managed futures. However, investors may want to consider a more holistic view when it comes to portfolio construction. Managed futures could mitigate losses to your portfolio when market volatility increases and asset prices drop.

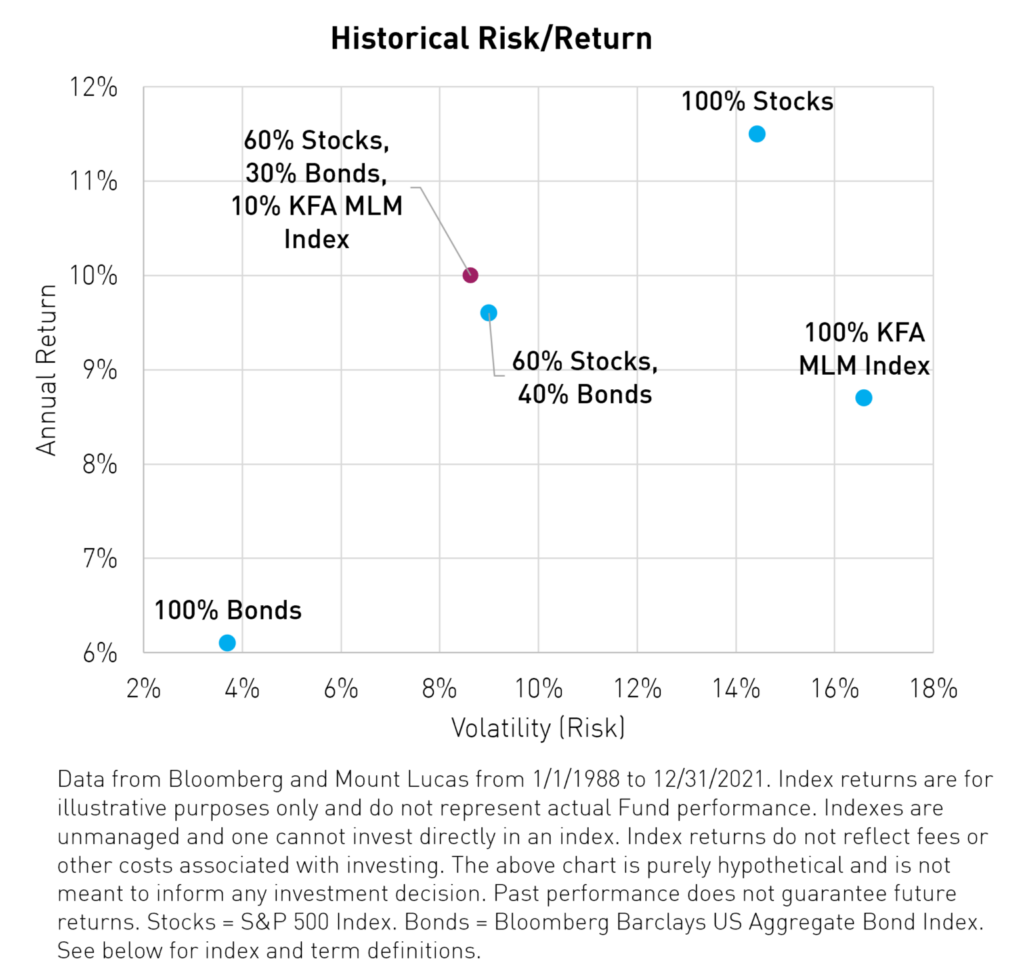

During times of increasing volatility, an investor may want more managed futures exposure because of its ability to diversify* a portfolio. While this sometimes comes at a cost as volatility settles, it has the potential for better returns during high volatility and rapid market movements, that potentially affect the entire portfolio and can allow for continued exposure to the investments that are skewed negatively. The inclusion of managed futures to a well-diversified* investment portfolio may reduce both risk and drawdown when used as a complement to a traditional 60% stock and 40% bond portfolio. Allocating as little as 10% may yield risk-adjusted-performance benefits. Let’s again look at the KFA MLM Index Historical Risk/Return.

In years where we’ve witnessed market volatility, having a managed futures investment in your portfolio, potentially has the effect of allowing you to hold your stock and bond investments through tough times, being in a position for the eventual recovery.

The KFA MLM Index ETF (Ticker: KMLM) delivers managed futures strategy through an ETF run by KFAFunds and Mt. Lucas.

*Diversification does not ensure a profit or guarantee against a loss.

Citations

- Data from Bloomberg as of 3/8/22

Index Definitions

The Bloomberg US Treasury: 1-3 Year Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 1-2.999 years to maturity. Treasury bills are excluded by the maturity constraint but are part of a separate short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting.

The S&P 500 index is an unmanaged index consisting of 500 stocks chosen by the Index Committee of the Standard and Poor’s Corporation that generally represents the Large Cap sector of the U.S. stock market. Returns for the S&P 500 index reflect the reinvestment of all dividends.

The Nasdaq-100 is a stock market index made up of 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock market. It is a modified capitalization-weighted index.

The Real Estate Select Sector TR Index is a subindex of the S&P 500. The Index seeks to provide an effective representation of the real estate sector of the S&P 500 Index and seeks to provide precise exposure to companies from real estate management and development and REITs, excluding mortgage REITs.

KFA MLM Index (“KMLM’s Index”): The KFA MLM Index is a diversified trend following portfolio of commodity, currency, and global fixed income futures contracts traded on US and foreign exchanges. The performance data for the index is a representation of the MLM Index from 1/1/1988 to 12/31/2004, the MLM Index EV (“EV”), with enhanced Execution and Volatility characteristics, from 1/1/2005 to 11/30/2020, and, using the same methodology as the “EV,” the KFA MLM Index from 12/1/2020 on.

r-ks-sei