KMLM Commentary Q2 2023

Index and Sector Performance

The Mount Lucas Managed Futures Index Strategy ETF (Ticker: KMLM)'s Index, the KFA MLM Index, finished the second quarter of 2023 up 3.1%. Commodity (-1.3%) markets detracted from performance, while Global Fixed Income (+2.1%) and Currency (+1.2%) markets were additive. Interest income added 1.2%. For the twelve months ending June 2023, the Index was up 1.3%.

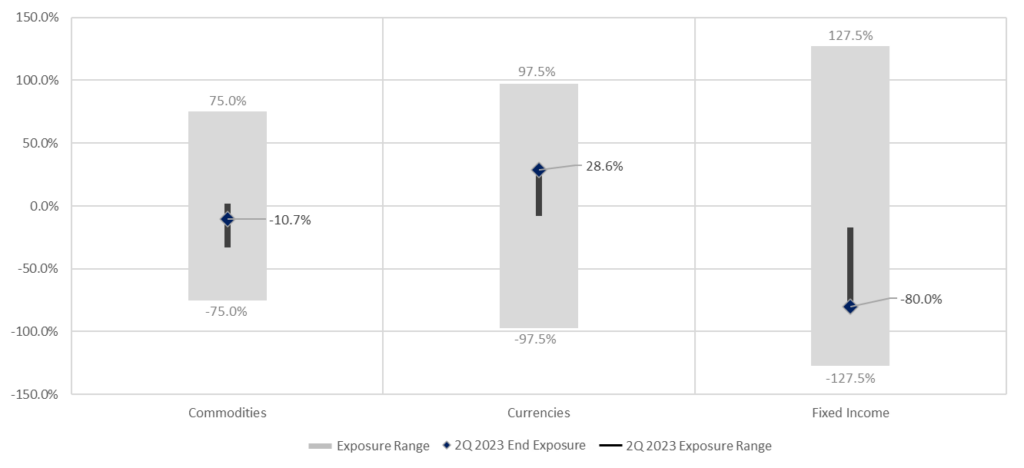

Index and Sector Exposures

Over the course of the quarter, Commodity exposures finished the quarter where they started at net short 11%. Currency exposures went from net short 11% to net long 29%. Global Fixed Income exposures went from net short 64% to net short 80%.

Outlook

The second quarter of 2023 saw the regional bank crisis set aside, and all eyes focused on the debt ceiling crisis. This hit trend markets as KMLM's Index saw bond exposures reduce their shorts and commodities get shorter through the end of May. The Fed paused, peak rates seemed to be in, and recession was still in play with corresponding future cuts priced in. Well, the data hasn’t quite cooperated yet, and the Fed has walked back the pause a bit, and inflation is back on the table. Bond prices have returned to their downtrend. The notable exception is the Japanese Government Bond, where a monetary yield curve control policy has elevated prices. With 10-year bond yields at 0.5% in Japan and T-Bills over 5% in the U.S., naturally, the Japanese Yen continues to weaken. In contrast, other currencies have started to gain against the Dollar, particularly over the last month, and KMLM's Index has started to increase long exposure there.

In the Commodity sector, performance was modestly negative across mixed positions in the quarter. Several markets are holding onto their trends (Live Cattle, Crude Oil, Wheat), but others have started to get range-bound and choppy (Corn, Copper, Soybeans). A great trending short in Natural Gas has rallied a bit off the bottom after a steady decline for most of the year. In the Grains, a major crop report at month-end showed higher than expected planted acreage in Corn (bearish), lower than expected in Soybean (bullish), and as expected in Wheat (neutral). These are weather markets though, and prices will depend on conditions in the coming weeks.

Year to date as of 6/30/23, KMLM's Index is up 0.2%, recovering the loss in the first quarter. Correlations across markets and sectors are low, as individual market fundamentals dominate over macro themes, in contrast to 2022.

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.