KMLM Sees Strong Performance Continue Amidst Global Market Strain in Q3

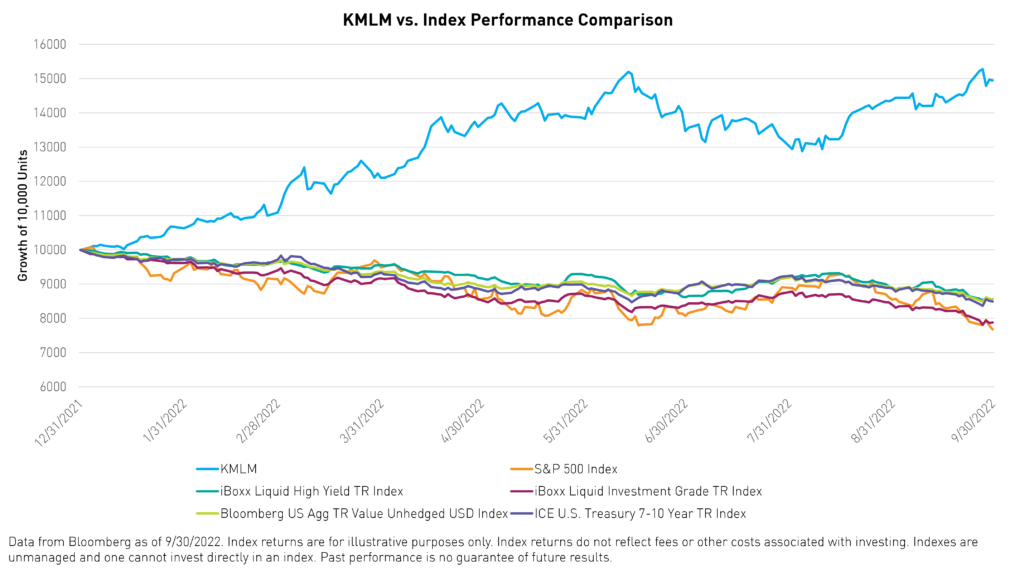

For traditional equity and fixed-income investors, Q3 2022, and 2022 as a whole, have been far from a smooth ride. While stocks and bonds were feeling the strain across the globe, managed futures remained a bright spot, with the KFA Mount Lucas Index Strategy ETF (Ticker: KMLM) up 11% for the quarter and 44% so far this year as of 9/30/2022.

With the continued uncertainty and volatility in the market, we believe investors could continue to appreciate the benefits of holding and potentially increasing their portfolio allocation to managed futures.

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.

The KFA Mount Lucas Index Strategy ETF (Ticker: KMLM) tracks the KFA MLM Index, which is managed by Mount Lucas Management LP. The rules-based passive index is designed to follow price trends in the commodity, currency, and fixed-income markets, dynamically adjusting between long and short positions based on trend signals in 11 commodities, 6 currencies, and 5 global bond markets.

KMLM and Sector Performance

KMLM finished the quarter up 11.0%. Currency (+6.6%) and Global Fixed Income (+5.7%) markets contributed to positive performance while Commodities (-1.9%) detracted from results. Interest income added 55bps. For the twelve months ending September 2022, the fund is up 44.0%.

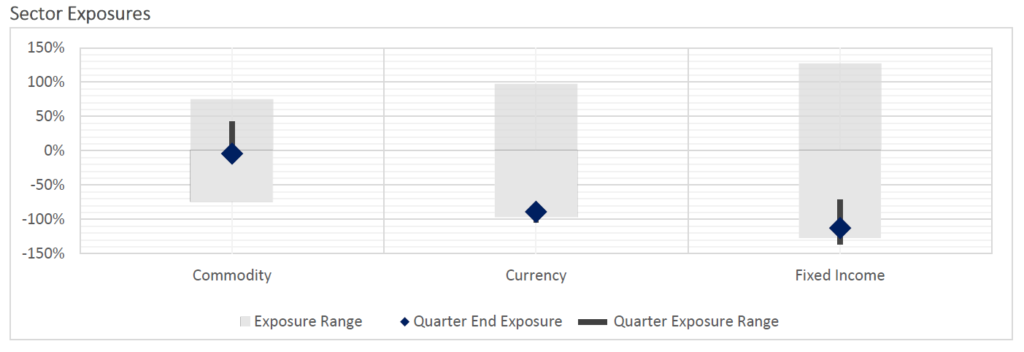

KMLM and Sector Exposures

Throughout the quarter, Commodity exposures went from net long 36% to net short 4%, Currency exposures went from net short 88% to net short 89%, and Global Fixed Income exposures went from net short 123% to net short 113%.

Outlook

The Index entered the quarter somewhat long commodities, long the Dollar, and short bonds. Commodity prices continued their downtrend through the end of the quarter as recessionary fears were priced in. This particularly affected the energy and agricultural positions leading to a loss in the sector. At the end of the quarter, the Index had a small net short in the sector. The long Dollar positions were very profitable in both August and September leading to another great quarter in the currency sector. After a bounce in Global Fixed Income prices in July, markets resumed their downtrend (rising rates) and delivered strong results in August and September.

The end of the quarter was really tough, with bonds and stocks both crushed, regardless of locale. There were panic moves everywhere, particularly in sterling. Third-world type emergency action is considered to control the slide. If the Fed’s mission was to break something, well, mission accomplished. Negative skew everywhere. There was, almost, no place to hide.

Almost because there was one place to hide, a well-known asset class that advertises success in periods of adversity and volatility. An asset class that exhibits positive skew, or as our partners at Mount Lucas like to say, it crashes up. An asset class that is up this year, and up this month, yet is not particularly dependent on manager skill. Simple alternative beta indexes capture the returns nicely. It's liquid and easy to access in a variety of formats.

What is it, you say? It's Managed Futures, of course. Now let us warn you. There will come a point when the markets will settle down, "Darth Powell" will take his foot off the brake, and traditional assets will recover. Managed futures will likely give back some recent gains. But if you had it in your portfolio, the profits you gained could have been rebalanced into those cheap equities and credits, primed for the next move higher. It’s a beautiful thing, but you need to be in the game to win.

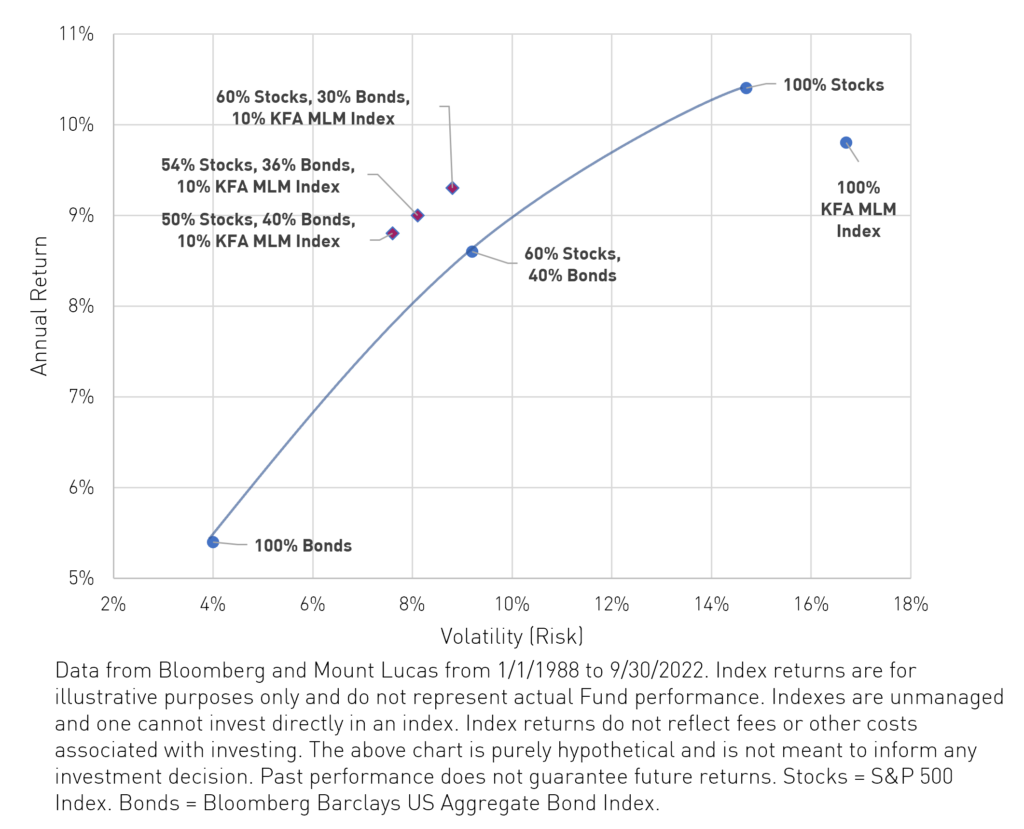

Tracking the KFA MLM Index may reduce both risk and drawdown when used as a complement to a traditional 60% stock and 40% bond portfolio. Allocating as little as 10% may yield risk-adjusted performance benefits as demonstrated in the chart below.

Term Definition:

Skew: is a statistical measure of how returns behave in the tails of a probability distribution. If an investment (e.g., stocks) has negative skewness, the extreme returns are more likely to be negative than positive (it tends to crash). However, if its return has a positive skew (e.g., buying a call option on stocks), then its large returns are more likely to be positive than negative.

Index Definition:

The MLM Index EV (15V) “Index” - serves as a price-based benchmark for evaluating returns available to investors in the futures markets. The Index applies a pure systematic trend following algorithm across a diversified portfolio of 11 commodity, 6 currency, and 5 global bond future markets.

S&P 500 Index - a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States.

iBoxx Liquid High Yield Index TR - consists of liquid USD high yield bonds, selected to provide a balanced representation of the USD high yield corporate bond universe.

iBoxx Liquid Investment Grade Index TR - designed to reflect the performance of US Dollar (USD) denominated investment grade corporate debt.

Bloomberg US Agg TR Value Unhedged USD - a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

ICE U.S. Treasury 7-10 Year TR - is market value weighted and is designed to measure the performance

of U.S. dollar-denominated, fixed rate securities with minimum term to maturity greater than seven years and less than or equal to ten years.