KMLM: Long USD and Short Other Currencies Shine While Commodities Retreat in Q2

The concept of managed futures has been around for decades. Managed futures’ key benefits for investors are their ability to potentially mitigate portfolio risk and their greater potential for negative correlations during periods of market stress. This year, managed futures are back in focus due to their strong performance which contrasts with the general weakness in both global equity and fixed income markets.

The KFA Mount Lucas Index Strategy ETF (Ticker: KMLM) tracks the KFA MLM Index, which is managed by Mount Lucas Management LP. The index is designed to follow price trends in the commodity, currency, and fixed income markets, dynamically adjusting between long and short positions based on trend signals in 11 commodities, 6 currencies, and 5 global bond markets.

KMLM entered the quarter positioned to be long commodities, long the dollar, and short bonds. After a strong April and May, long commodity holdings gave back a decent amount in June. The long dollar positions were favorable in both April and June, leading to a solid quarter in the currency sector. Global bonds were the highest performing sector as short positions were delivered throughout the quarter.

KMLM and Sector Performance

KMLM finished the quarter up +11.6%. Commodity (+2.0%), Currency (+3.9%) and Global Fixed Income (+5.5%) markets all contributed to performance. Interest income added 16bps. For the twelve months ending June 2022, the fund is up +33.1%.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate such that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost, and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 646-895-9009 or visit our website at www.kfafunds.com.

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.

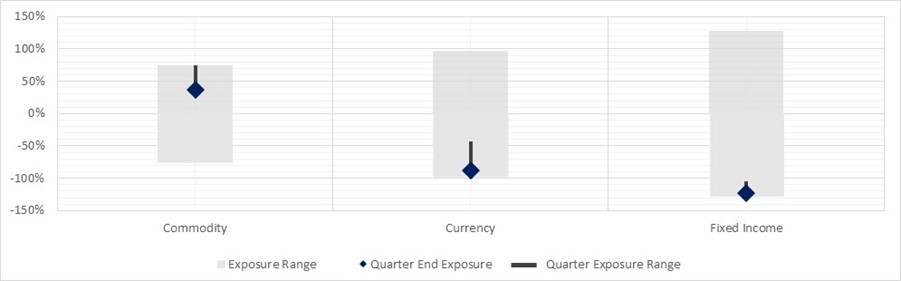

KMLM and Sector Exposures

Throughout the quarter, Commodity exposures went from net long 71% to net long 36%, Currency exposures went from net short 71% to net short 88%, and Global Fixed Income exposures went from net short 112% to net short 123%.

Outlook

The elephant in the room for markets in the past few months has been the continued rise in inflation across the globe and what this has done to asset prices. Stocks and bonds have had awful starts to the year. Through the end of June, the S&P 500 is down -20%, long-dated government bonds down -22%, high yield corporate debt down -13.8%, and investment grade corporate debt down -16.2%.1

In the managed futures space, we have seen a much stronger USD and commodity markets with large price swings in grains and oil markets. The war in Ukraine is adding volatility. Central banks everywhere are moving quickly to raise interest rates to reset policy from the ultra-accommodative levels we saw during and post (hopefully now finally post?) pandemic to neutral and then an outright restrictive policy stance.

The balance in doing this without overcorrection and a recession is a fine line to tread. The policy shifts are following the data, which is unusually volatile given the rollercoaster of activity over the past couple of years. As the markets follow and extrapolate the policy changes, the volatility is amplified. Markets priced for near perfection, assuming low and predictable rates for years, have had to take a hard look in the mirror. The image that stares back is more uncertain and warrants lower prices. The strange thing is that activity data has been phenomenal. The first six months of the year have seen some 2.7m jobs added at an average of ~450k per month, and the unemployment rate matches records, with wages growing as well.

Despite the recent pullback, the tightness we see in almost all commodity markets looks to be here for the foreseeable future – many have long investment cycles. They have been structurally underinvested from a CapEx perspective for many years. It isn’t possible to drastically alter the amount of oil or industrial metals we can supply that fast. Indeed not as fast as economies opening from pandemics with pent-up demand require.

Currency markets were maybe the most interesting in the quarter as the dollar strengthened. Currency markets are often the sharp end of macro volatility; this was no exception. The Japanese central bank is trying to maintain 10-year yields at 0.25% as the Federal Reserve is moving by 75bps a meeting. That is undoubtedly driving the almost disorderly weakening of the yen and acts as a great use case example as to why long/short positioning in futures markets can fit so well into portfolios with more traditional stocks and bonds. On one side, faster rate hikes are hurting equity multiples – on the other, the same driver is helping propel gains in short Yen positions.

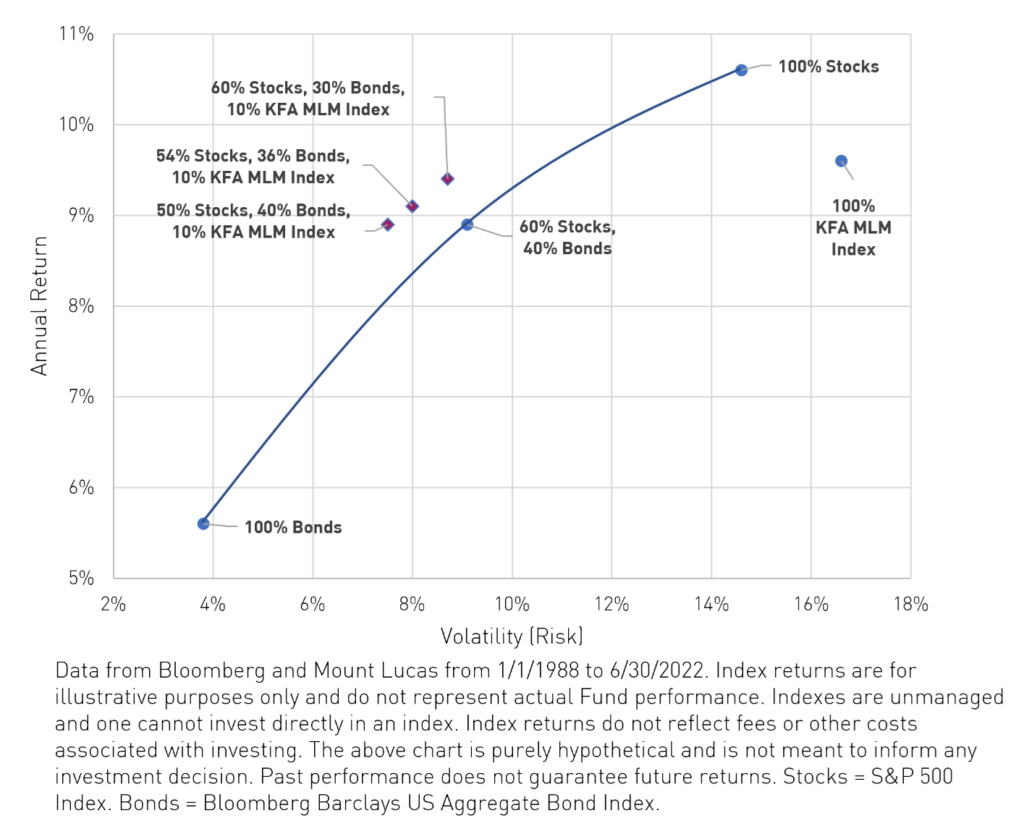

Tracking the KFA MLM Index may reduce both risk and drawdown when used as a complement to a traditional 60% stock and 40% bond portfolio. Allocating as little as 10% may yield risk-adjusted performance benefits as demonstrated in the chart below.

Citation:

- Data from Mount Lucas Management LP as of 6/30/2022.

Index Definition:

The MLM Index EV (15V) “Index” - serves as a price-based benchmark for evaluating returns available to investors in the futures markets. The Index applies a pure systematic trend following algorithm across a diversified portfolio of 11 commodity, 6 currency, and 5 global bond future markets.