Uncertain Equities & Under Yielding Bonds: Why Tim Rudderow Thinks Now Is The Time For Managed Futures

The seemingly unstoppable bull run in US equities, record-high commodity prices, rising inflation, and chronically low interest rates have many investors reevaluating the traditional investment portfolio. Against this backdrop, we spoke with Mount Lucas President and Chief Investment Officer Tim Rudderow. Having co-founded Mount Lucas in 1986, Tim pioneered the field of systematic trend-following and managed futures that can provide uncorrelated returns, especially during market shocks. Tim shared his perspective on the value of managed futures in the current market environment and the potential addition of cryptocurrencies, the Renminbi, and carbon allowances to the KFA MLM Index, the underlying index for the KFA MLM Index Strategy ETF (Ticker: KMLM).

Some financial advisors are leery of managed futures. They can be challenging to explain to clients, and their price drivers may not be as intuitive as traditional equity or fixed-income investments. Would you please give us a brief overview of what managed futures are for the uninitiated and cover the logic for managed futures and the historical role they have played in investor portfolios from a strategic perspective?

In order to understand managed futures, the investor must first appreciate the role futures markets play in the financial ecosystem. Futures markets have developed over the last 200 years to allow commercial interests – businesses – to transfer price risk. All businesses face the risk of fluctuating commodity prices, interest rates, and currency values – these are risks that are not core to their business. For example, an airline is in the business of flying passengers, not forecasting the price of jet fuel. Futures markets allow the airline to “hedge” that risk, that is, lock in the price for the future. This allows them to stabilize their cost base, permitting more accurate pricing and planning in their core business.

Futures are different than other financial markets in that the risks exist on both sides of the market, long and short. That is, the oil producer has the mirror image risk of the airline, an oil product consumer. Both of these players want to reduce their risks and their trades often offset one another. But in times of financial disruptions, when supply and demand balances are moving abruptly, investor capital is required to absorb the risk. Intuitively, we would suspect that since the commercial interests are lowering their risk, investor capital should receive a premium for absorbing that risk. In addition, since that premium is paid in periods of high volatility, periods where traditional investments often suffer, we might expect the returns to futures investment to provide an independent, diversifying return stream.

In 1988, Mount Lucas Management developed the first price-based index to capture the return characteristics of futures investments. It employs a simple, cost-effective, replicable trend following algorithm to mimic the activity of investors in futures markets.

An allocation to systematic trend-following/managed futures can benefit a portfolio in several ways. During periods of price stability and low volatility, the KFA MLM Index attempts to offer longer periods of moderate returns in a cost-efficient manner (low fees, low portfolio turnover/trading costs) while being subsidized by the returns of the traditional asset allocation. However, during periods of price dislocation, high volatility, or in what are commonly referred to as “tail events”, the KFA MLM Index strives for shorter periods of high returns, subsidizing the poor performance of the traditional asset allocation. Managed Futures and Systematic Trend Following also attempt to generate returns in poor equity environments without having to “time the market” or reduce traditional asset class exposure during adverse market conditions.

Commodity prices are reaching record highs. Inflation is also on the rise. Everyone is questioning how long the US equity rally can last. Given these conditions, do you think now is a good time for investors to consider this type of strategy?

If rising commodity prices and inflation continue, the resulting economic headwind will likely create a difficult environment for equities, and the potential for rising interest rates to combat inflation may hurt a traditional bond portfolio at the same time. On the other hand, managed futures strategies tend to perform well during periods of sustained price movements, both up and down, adding much-needed diversification to a traditional portfolio allocation.

Global energy demand is soaring. Coal production in the US is on track for its first year-over-year rebound since 2014. Will soaring energy costs continue? How is the portfolio positioned to potentially benefit from this trend?

In truth, energy prices are extremely difficult to forecast and it is impossible to know whether prices will continue to rise. What we do know is that the trend-following approach of a managed futures portfolio such as the KFA MLM Index is likely to benefit from sustained price movements, up or down, providing diversification to a portfolio in the face of uncertainty. Normally, rising prices in a commodity incentivize a supply response (i.e., more drilling, more fracking, etc.), eventually driving those prices back down. We will see how this plays out given the global focus on ESG and renewable energy.

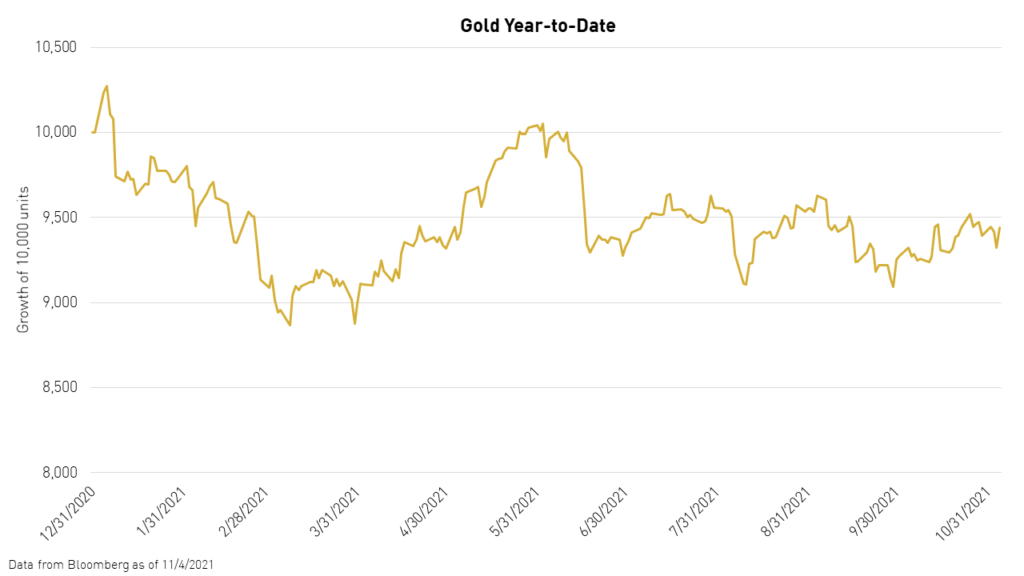

You are currently short gold despite rising inflation. Can you explain your rationale for that?

The KFA MLM Index is currently short gold for a simple reason: the price of Gold has trended lower, even in the face of rising inflation. The KFA MLM Index uses a trend-following approach to determine long and short positions and does not rely on forward-looking forecasts, which tend to be inaccurate.

The KFA MLM Index uses a trend-following algorithm to signal the inception of possible price dislocations. Based on these trends, the index takes a long or short position depending on the direction of the price dislocation. These trend signals are executed in small increments over a period of several days to minimize the overall market impact as well as be less sensitive to rangebound market moves. In the case of gold, the market has moved sideways for much of 2021 with no sustained trend occurring. This sideways price action has tightened the market premium/discount to the moving average, leaving the index in a position to potentially capture any sustained price action lower while also being well-positioned if the price were to rise, effectively allowing the index to enter on the ground floor should a trend higher form.

You aren’t adding bitcoin futures to the basket yet. Can you explain why?

Just like the S&P 500 is designed to represent the returns to investing in the US equity markets by looking at the 500 largest companies, the KFA MLM Index is designed to be representative of the returns to investing in the futures markets by looking at the largest and most liquid contracts. We continue to monitor the market of virtual currency futures such as bitcoin, but these markets need to grow and mature before they can be added to the KFA MLM Index.

What milestone would Bitcoin have to hit for you to consider it mature? Is there any other FX position you would compare to bitcoin?

From our perspective, there are still many questions that need to be answered about bitcoin and other cryptocurrencies. Should Bitcoin be considered a currency, a representative of a new “Crypto” sector in an equity manner, or a commodity, considering that it is mined? Additionally, is it just Bitcoin futures that should be added, or should there be a basket of futures on a group of cryptocurrencies? There are futures on one other cryptocurrency, Ethereum. They started trading this year and would need to reach at least one year of price history to be eligible for inclusion in the index. Recently, Bitcoin futures contract volume has picked up significantly with the launch of the corresponding ETF. The index is reviewed annually by our index committee and this will be a topic of discussion, along with Carbon, but the maturity of the spaces will have to be considered.

We would be more comfortable adding Bitcoin or some other cryptocurrency to the basket if and when it became a significant transactional tool, rather than purely a speculative vehicle. Regular commercial trade conducted in crypto – buying a car or selling goods overseas – would indicate the need to hedge these transactions and maturation from a purely speculative vehicle. However, the legitimate goods and services trade that is denominated in bitcoin or any other cryptocurrency has not reached the volume necessary for inclusion.

Given our firm’s China connection, we have to ask: will you ever add the Renminbi?

Currently, futures contracts for the Renminbi on the CME are only very lightly traded. We constantly monitor futures markets for potential additions.

What are your thoughts on carbon allowance futures?

Similar to virtual currency futures, we will continue to monitor carbon allowance futures and consider them for inclusion in the KFA MLM Index as the market expands and matures.

What are the advantages of owning managed futures in an ETF versus in separately managed accounts (SMAs) or other vehicles?

Historically, gaining managed futures exposure has often involved complex, expensive, and tax-inefficient vehicles such as private funds that were only accessible to large institutions and ultra-wealthy individuals. KMLM represents an evolution in the democratization of managed futures, providing an efficient and low-cost exposure to managed futures that is available to all investors.

Diversification does not ensure a profit or guarantee against a loss. Buying and selling shares of the KFA Funds may result in brokerage commissions.

r-ks-sei