The latest news and research from our partners. Subscribe to our mailing list for more.

August 16, 2024 – Dave Aspell of Mt Lucas – An Institutional Perspective on the Simplicity of Trend Following

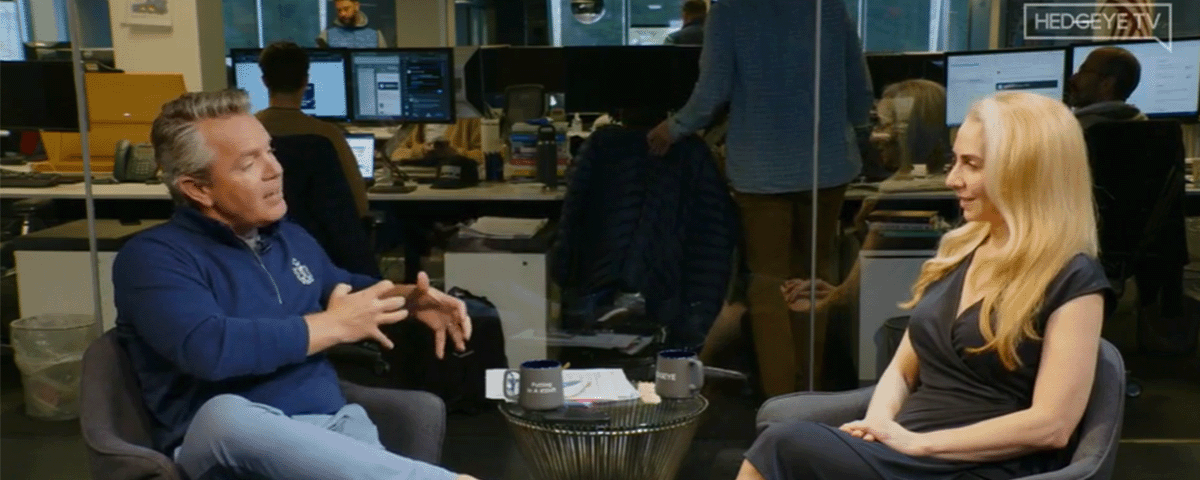

April 20, 2023 – Before SVB Collapse, Nancy Davis Warned of “Short Fixed-Income Volatility Exposure” on CNBC

April 3, 2023 – Has the US Fed Put Inflation Aside to Focus on the Banking Crisis?

March 27, 2023 – CNBC: Nancy Davis on 25bps Bump and IVOL

KFA Funds is a premier platform for developing and delivering differentiated, high-conviction investment strategies to global investors. Our newsletter is a collaboration between our internal research department and our distinguished partners. Together we strive to offer differentiated perspectives on high-conviction investment strategies and themes.

280 Park Avenue, 32nd Floor

New York, NY 10017

1 Embarcadero Center, Suite 2350

San Francisco, CA 94111

181 Queen Victoria Street

London EC4V 4EG

Hyperlinks on this website are provided as a convenience and we disclaim any responsibility for information, services or products found on the websites linked hereto.

Click here to continueThis website uses cookies to help us enhance your browsing experience. By using this website you consent to our use of these cookies. You can customize your preferences by clicking “Cookie Preferences” below. To find out more about how we use cookies and how to manage them, please see our Terms & Conditions and Privacy Policy.