IVOL Q3 Quarterly Update

By Nancy Davis CIO of Quadratic Capital

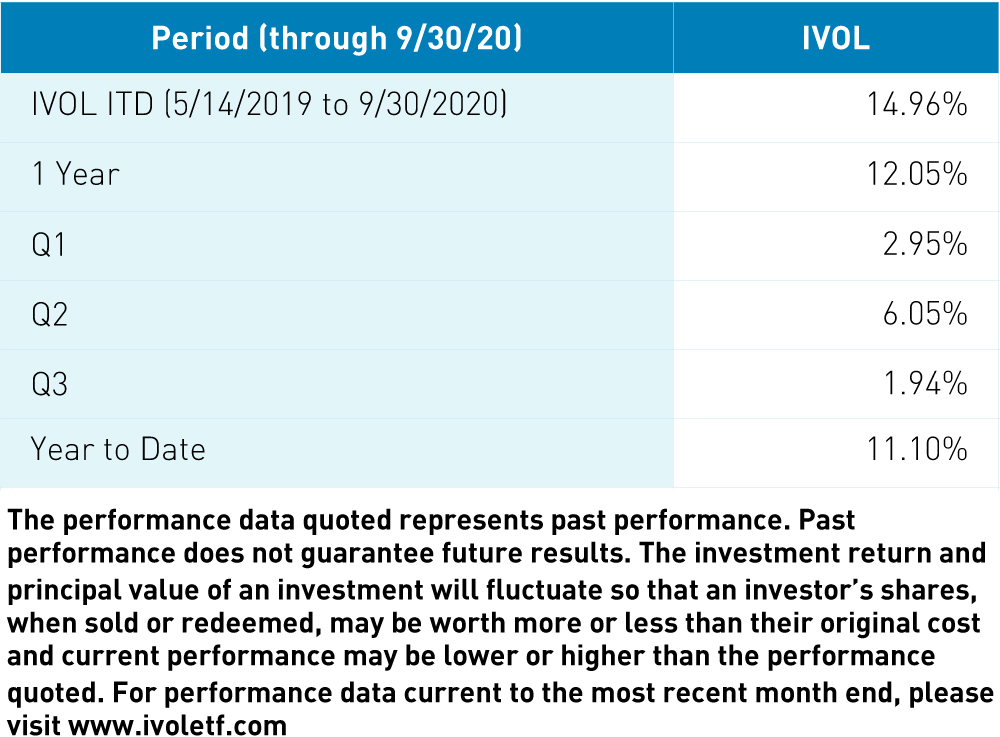

After a positive performance during the first quarter selloff, IVOL has continued to perform well in the second and third quarters as the markets recovered and rallied. Many investments that did well during the selloff had a harder time when markets rallied. IVOL investors did not experience such an outcome, with IVOL turning in positive returns in both environments. Please see the most recent performance data in the table below:

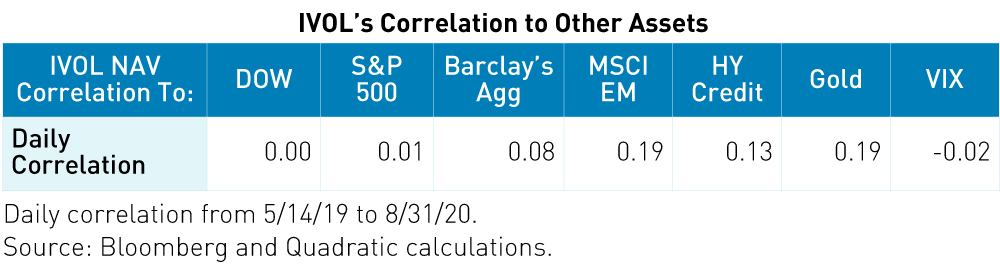

In addition to IVOL’s positive performances during each of 2020’s three very different quarters, investors may note IVOL’s historical correlations to common asset classes, and its potential as a portfolio diversifier.

As the table below shows, IVOL has had very low correlations with common asset classes. In this environment, many investors are looking to add holdings that reduce the volatility of their portfolios. Investments with such low correlation coefficients can be very attractive to such investors. Please see the specific correlation data in the table below:

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please visit www.ivoletf.com.