BNDD: Leveraging Options to Enhance Your Treasury Returns and Build Resilient Portfolios

Bullish on bonds? Think rate cut expectations are too aggressive? Hoping to lock in today’s yields before they start falling? Want to add carry to your portfolio but leery of taking more credit risk?

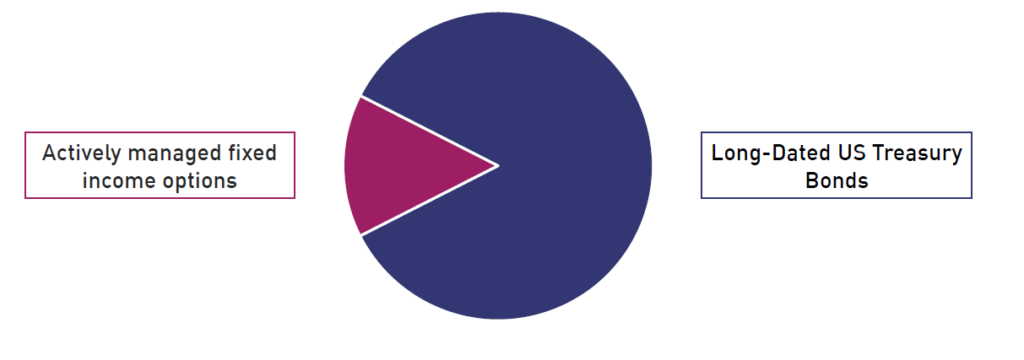

The Quadratic Deflation ETF (BNDD) is an actively managed government bond ETF that seeks to benefit from lower growth, deflation, lower or negative long-term interest rates, and/or a reduction in the spread between shorter and longer-term interest rates by investing in U.S. Treasuries and options. BNDD has the potential for enhanced returns in periods of lower economic growth by augmenting its exposure to long-dated Treasuries with a portfolio of long-only OTC options.

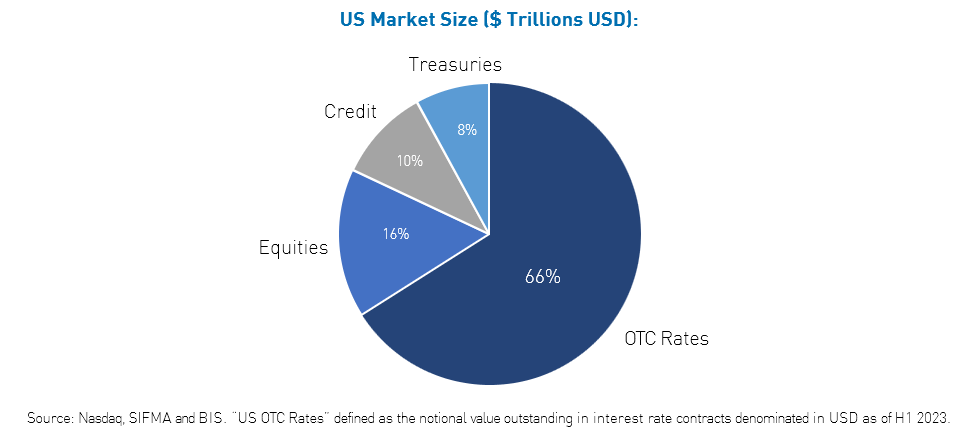

This strategy is unique because of the access it gives investors access to the world’s largest asset class, the OTC rate market. BNDD’s portfolio of long-only options on the shape of the U.S. interest rate curve could potentially make this strategy a diversifier to a fixed-income portfolio.* The options held by the fund could also potentially serve as a market hedge if the expected Fed cuts do not happen or when long-dated bonds rally moving their yields lower.

The market is currently pricing in about –125bp (as of 12/31/23) of rate cuts for 2024. If those rate cuts are not delivered, the OTC options inside the fund could potentially enhance the return of the fund’s Treasuries. Also, If the spread between shorter-and longer-term interest rates compresses, either because of lower inflation expectations and/or deflation, BNDD could potentially benefit.

BNDD could also function as a complement to long-duration Treasuries or as a more efficient position. A smaller allocation to BNDD could provide similar exposure with the added benefit of an options portfolio to potentially enhance returns. Of course, because of its unique option component, investors should expect BNDD returns to be more volatile than investments in long-only Treasuries.

By incorporating options, BNDD’s distributions may also enhance conventional fixed-income portfolios. BNDD has distributed a minimum of 30bps monthly since the fund started paying distributions.**

For BNDD standard performance, including 30-Day SEC Yield, please click here.

BNDD offers a unique opportunity for investors amid uncertainty in the fixed-income markets. The fund's strategic focus on lower growth and deflation, combined with its inclusion of long-only OTC options, positions it as a potential hedge against unmet Fed rate cut expectations. With consistent monthly distributions and the ability to enhance portfolio diversity, BNDD stands as a compelling choice for investors seeking a strategic and efficient approach to a strategic and efficient alternative for current market conditions.

*Diversification does not ensure a profit or guarantee against a loss.

**Some of these distributions may include return of capital.