Coffee or Espresso? Right-Sizing US Treasury Exposure with BNDD

Many of us rely on coffee to power through the day. Instead of an extra-large coffee, perhaps an espresso would be a better solution? It provides the same effect more efficiently. It usually tastes better, too! With today’s market volatility, investors have taken steps to become more diversified. But, could we diversify more efficiently?

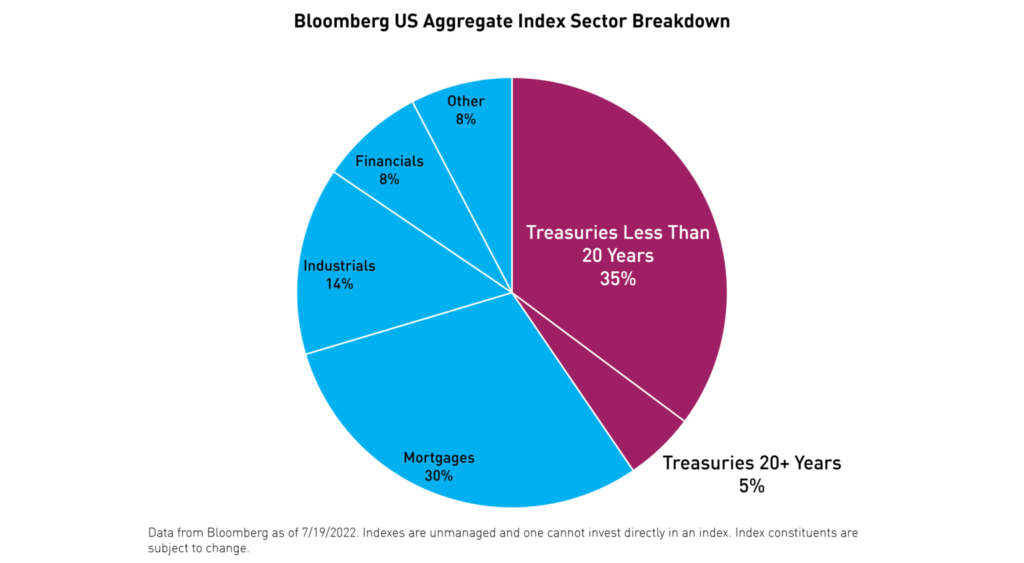

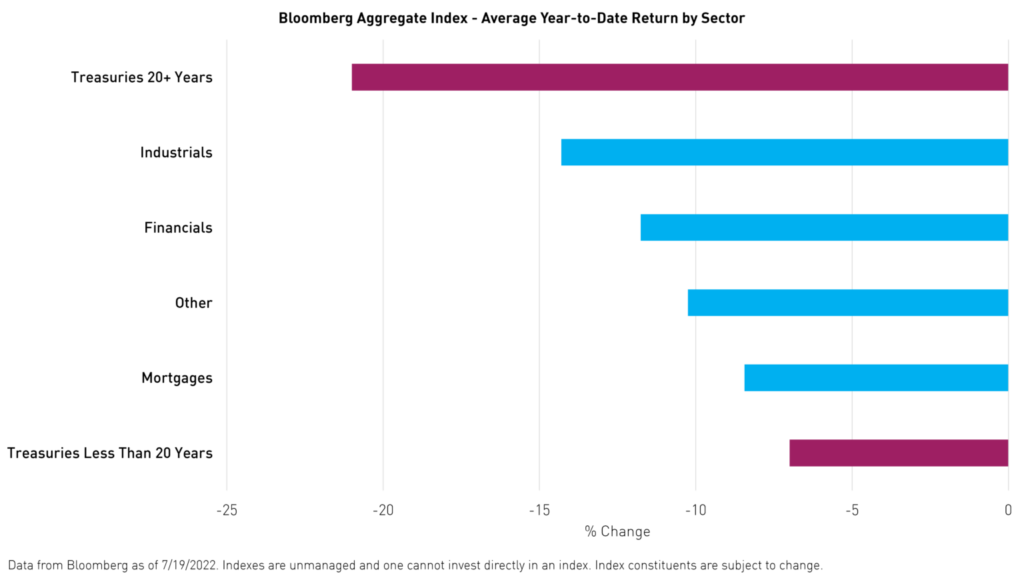

It has been a tough year to invest in bonds. The Bloomberg US Aggregate Bond Index (the “Agg”) is down -10.14% year-to-date as of July 20, 2022. And while investors may be attracted to the security of US sovereign debt, investing in traditional long-dated US Treasuries has been even more painful. The ICE US Treasury 20+ Year Index is down over -22.86% year-to-date as of July 20, 2022. Inflation remains the top enemy of fixed-income investors.

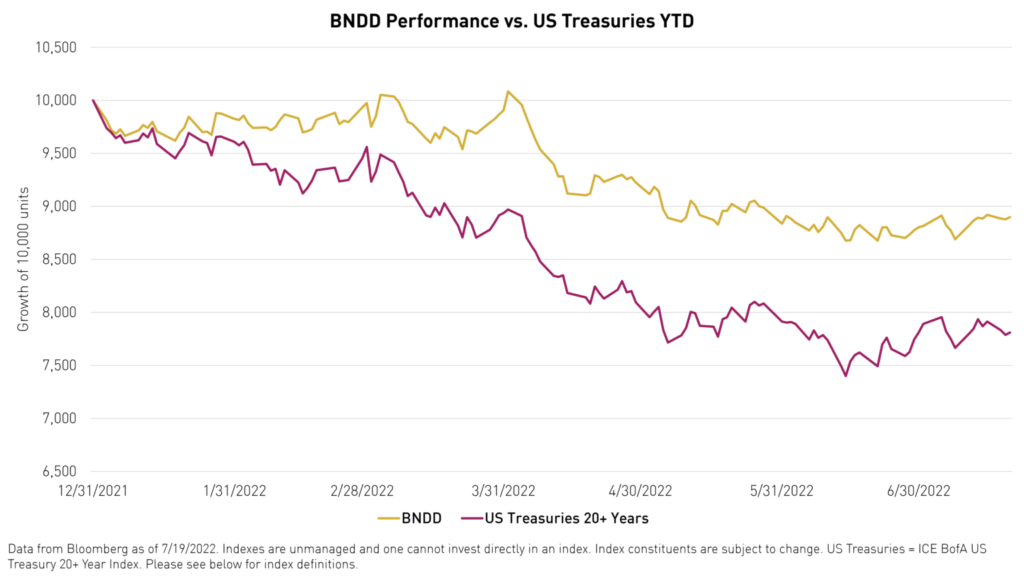

Investors who want to retain an allocation to long-dated US Treasuries but fear that an aggressive Fed might push the economy into recession may wish to consider the Quadratic Deflation ETF (BNDD).

BNDD’s portfolio is comprised primarily of long-dated US treasury bonds, augmented with long-only options on the shape of the US interest rate curve. This fund has the potential to benefit when 30-year yields decline or when short-term rates rise. These are the sort of changes in interest rates one may expect if the Fed continues hiking or the economic outlook worsens.

BNDD could function as a complement to long-duration Treasuries or as a more efficient position. A smaller allocation to BNDD could provide a similar exposure with the added benefit of an options portfolio to potentially enhance returns. This could allow investors to enhance the diversity of their portfolios. Of course, because of its unique options component, investors should expect BNDD returns to be more volatile than an investment in long-only Treasuries.

In this year’s challenging market environment, BNDD has outperformed long-dated US Treasuries as measured by the ICE US Treasury 20+ Year Index by +12.23%.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate such that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost, and current performance may be lower or higher than the performance quoted.

For BNDD standard performance, top 10 holdings, risks, and other fund information, please click here.

Investors who want to hold Treasuries but worry about the Fed and the economy may want to consider BNDD as a potential solution.

Potential Risks

BNDD could be a risk additive in a portfolio of treasury bonds when yields are rising. In a rising long-term yield environment, BNDD is likely to lose money. Those losses could be amplified by losses in the options if the yield curve steepens. The strategy is also likely to perform poorly when bonds sell off. The options held by the fund might not work as market hedges, especially when policy rates are away from zero.

Diversification does not ensure a profit or guarantee against a loss.

Index Definitions:

ICE US Treasury 20+ Year Index - is part of a series of indices intended to the assess U.S. Treasury market. The Index is market value-weighted and is designed to measure the performance of U.S. dollar-denominated, fixed-rate securities with minimum term to maturity greater than twenty years.

Bloomberg US Aggregate Bond Index - a broad-based benchmark that measures the investment grade, U.S. dollar- denominated, fixed-rate taxable bond market.