As Geopolitical Tensions and Inflation Rise, IVOL May Diversify the 60/40 Portfolio

"A war on multiple fronts is underway in markets," wrote MarketWatch's Mark DeCambre in a recent article on his ETF Wrap column. He noted that in addition to the invasion of Ukraine, markets are struggling with further supply chain disruptions, rising prices and slowing growth.

According to Nancy Davis, Quadratic CIO and portfolio manager for The Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL), this could be setting the stage for stagflation, a condition where prices increase, yet growth remains sluggish. Nancy pointed to the current environment of uncertainty to support this view. The United States is currently experiencing rising inflation, a hawkish Federal Reserve, and a host of other geopolitical risks to contend with on multiple fronts.

Stagflation may be looming. Over the past 12 months, U.S. consumer prices rose by 7.5%, the highest rate in nearly 40 years1. Oil is currently trading at a 7-year high, above 100 dollars a barrel2. Meanwhile, the labor shortage is accelerating. According to December data from the Federal Reserve Bank of St. Louis, US companies currently have 11 million unfilled positions, the third-highest month on record behind only July and October 2021. Yet unemployment remains at decade lows around 4% with less than 7mm Americans looking for work versus the 11mm of vacancies3. The conflict in Ukraine throws another major geopolitical ingredient in the “messy soup” of issues. In this environment, stocks and bonds could sell off in unison as the Fed raises rates to tackle inflation.

Introducing IVOL

Nancy Davis believes we are in unchartered territory, and investors may need to diversify beyond stocks and bonds in this environment. "I think it's all about non-correlated assets right now," Nancy Davis recently told CNBC.

Going into the Russian Invasion of the Ukraine, the interest rate markets fully priced in the Fed hiking over 150 basis points in 2022 plus additional hikes in 20234. The market is expecting rate hikes will solve inflation. Yet, Nancy believes the current labor market shortages, supply chain disruptions, and higher commodity prices may not be solved through rate hikes alone. This uncertainty presents a potential opportunity for IVOL.

IVOL combines over-the-counter options on the interest rate markets that are typically only available to institutional investors with U.S. inflation-protected treasuries (TIPS). This combination provides an exposure that is different than the traditional 60/40 portfolio. IVOL has the potential to do well with lower front-dated yield expectations, typically occurring in a more risk-off environment when equities and bonds are selling off or in a higher inflation expectation environment.

IVOL Performance

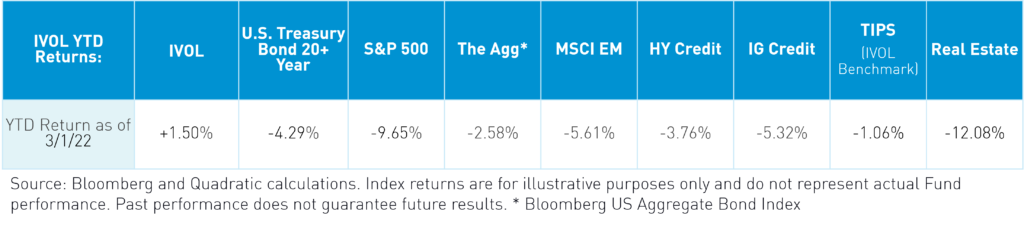

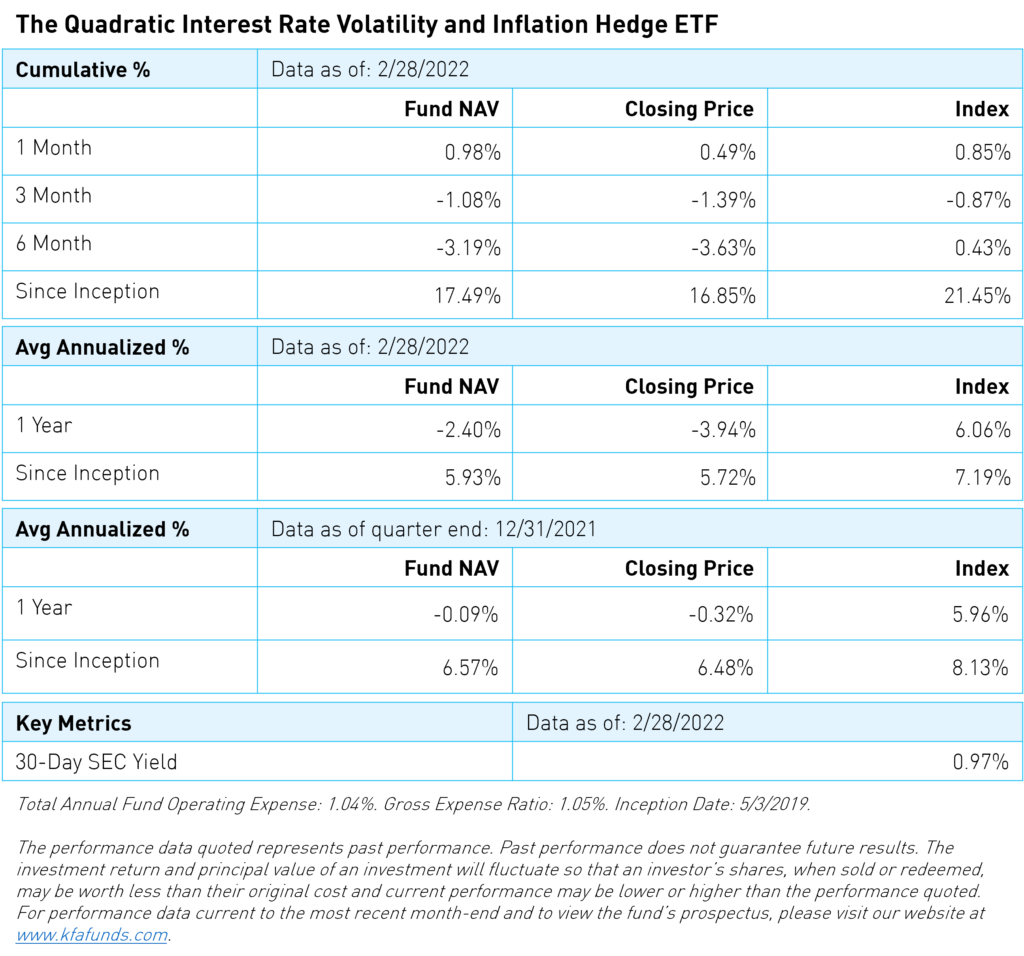

Since IVOL's inception, it's exhibited low correlation to major equity and fixed income indices. Year-to-date, IVOL has outperformed other asset classes as shown in the charts below.

IVOL may perform well during periods of uncertainty because it can potentially benefit from both fewer rate hike expectations and increasing inflationary pressures.

IVOL's Risk Profile

Investing involves risk, including possible loss of principal. There can be no assurance that the Fund will achieve its stated objectives, including its objective of eliminating the curve or inflation risk. Investors should take note of the following risks before investing in IVOL. A more thorough discussion of options investing can be found on the Options Clearing Corporation’s website. A link to which can be found in the Important Notes section of this presentation.

- A Flattening Yield Curve Risk: IVOL may underperform or lose money when the U.S. interest rate curve flattens or inverts, perhaps significantly. When this occurs the Fund’s investments may generally underperform a portfolio consisting solely of U.S. government bonds

- Leverage Risk: IVOL’s OTC options may give rise to a form of leverage, which may magnify the Fund’s potential for gain and the risk of loss. The Fund may potentially be more volatile than a portfolio of traditional investments such as stocks or bonds.

- Liquidity & Counterparty Risk: OTC options may be subject to liquidity risk and counterparty risk.

- Credit & Non-Curve Interest Rate Risk: IVOL’s use OTC options is not intended to mitigate credit risk, or non-curve interest rate risk. Additionally, IVOL invests in debt securities, which typically decrease in value when interest rates rise.

- Considered Speculative: Investing in options tied to the shape of the swap curve is considered speculative and can be extremely volatile.

- Concentration Risk: The fund is non diversified.

This commentary represents the manager's opinions on the market. It should no be regarded as investment advice or recommendation of specific securities.

Citations:

- Gwynn Guilford, “U.S. Inflation Rate Accelerates to a 40-Year High of 7.5%”, WSJ, 2/20/2022.

- Pippa Stevens, “U.S. oil price surges 11% to $106 a barrel, a 7-year high prompted by Russia’s assault on Ukraine”, CNBC, 3/1/22.

- U.S. Bureau of Labor Statistics as of 2/04/2022.

- Data from Bloomberg as of 3/1/22.

Index Definitions:

The Dow Jones Industrial Average (“Dow”) is an index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange and the NASDAQ.

The S&P 500, (“S&P”), is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the US.

The S&P U.S. Treasury Bond 20+ Year Index is designed to measure the performance of U.S. Treasury bonds maturing in 20 or more years.

Bloomberg US Aggregate Bond Index (The Agg), is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

The MSCI Emerging Markets (MSCI EM) Index captures large and mid cap representation across 26 Emerging Markets (EM) countries.

The Bloomberg US Treasury Inflation-Linked Bond Index (“TIPS”) seeks to measure the performance of the U.S. TIPS Market.

The S&P U.S. High Yield Corporate Bond Index is designed to track the performance of U.S. dollar-denominated, high-yield corporate bonds issued by companies whose country of risk use official G-10 currencies, excluding those countries that are members of the United Nations Eastern European Group (EEG).

The Real Estate Select Sector TR Index is a subindex of the S&P 500. The Index seeks to provide an effective representation of the real estate sector of the S&P 500 Index and seeks to provide precise exposure to companies from real estate management and development and REITs, excluding mortgage REITs.

The iBoxx iShares High Yield Corporate Bond Index (HY) is designed to reflect the performance of USD denominated high yield corporate debt.

Dow Jones Commodity Index Gold is designed to track the gold market through futures contracts.

VIX is a CBOE index that represents equity volatility of 30-day expectations of the S&P 500 equity index.

There are risks involved with investing in options including total loss of principal.

r-ks-sei