This trader thinks the inflation risk is underrated and gives her ultimate hedge

CNBC Fast Money - In this video, Nancy Davis, Quadratic Capital, offers a hedge on inflation risk and discusses the IVOL ETF strategy with CNBC’s Melissa Lee and the Fast Money traders, Guy Adami, Tim Seymour, Dan Nathan and Brian Kelly.

IVOL combines TIPS with long rate options. The strategy is designed to capture inflation expectations in a way that TIPS alone cannot. TIPS are long duration and reset their principal amounts based on CPI of which the single biggest component – roughly one third of the entire measure - is the cost of shelter, for which it largely uses rent as a proxy.

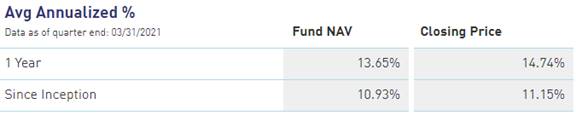

Looking back, IVOL was able to navigate the challenges of 2020 returning 14.56% for the year with positive performance in Q1 (including in the month of March 2020 when TIPS were down) as well as each subsequent quarter while maintaining a low correlation to traditional asset classes. In 2021, IVOL has continued to generate positive returns when most other fixed income funds posted negative returns in Q1 as interest rates increased. Additionally, IVOL has distributed a minimum of 30 bps monthly since July 2019.

With the Fed’s new strategy of average inflation targeting (AIT) coupled with US fiscal spending and the vaccine distribution underway globally, we would expect this environment to be potentially positive for IVOL.

IVOL was launched in May 2019 and we’ve seen very steady interest in the strategy, including a growing institutional client base which has included multiple endowments, pensions, family offices, asset managers and credit firms, among others.

For IVOL standard performance and top 10 holdings please click here. Past performance is no guarantee of future results. Diversification does not protect against market risk.

Krane Funds Advisors, LLC (KFA) has included links to unaffiliated third parties for informational purposes only. The links and the views of the third parties do not necessarily reflect the views of KFA, its management, employees, officers, and affiliated entities. All opinions, evaluations, descriptions and statements do not purport to be complete and are subject to change. KFA makes no representation as to the adequacy of information and should not be construed as an endorsement by KFA, its affiliated entities, management, officers, employees and agents.