Rocky Times Ahead: How KVLE Could Position Investors for Uncertain Markets

The first quarter of 2022 was challenging for the equity markets. The S&P 500 gave up -4.60% on a total return basis, its first down quarter since the pandemic-driven first quarter of 2020. Of course, Q1 2020 was just two years ago, but it is worth reminding ourselves how comparatively rare S&P 500 down quarters have been recently and what disasters they often require. Indeed, Q1 2022 was only the fourth red quarter for the S&P in the twenty-five quarters since September 2015.

And at points during the quarter, the situation seemed much worse. By the close of March 8, the S&P was down -12.26% year-to-date (YTD). It was only due to a solid late March rally that the quarter improved from awful to garden variety bad.

Yet March’s gains had the feeling of a joyless bear market rally. The three scary stories that presumably drove January and February’s losses, inflation, Fed actions to raise rates, and the war in Ukraine, continued without much in the way of good news. At best, the outlook became incrementally better because the situation did not grow much worse.

Indeed, it is worth observing that the market appears wholly unconcerned about the war in Ukraine. It rallied the day after the invasion was launched, and the S&P gained 7.39% from that date to quarter-end. One suggested explanation for this was that economic stress from the war and related sanctions would cause the Fed to delay or slow rate increases. That effect on the Fed does seem likely, but using it as an excuse to buy stocks seems irrational. It is like a man being overjoyed at breaking his arm because it means postponing a root canal scheduled later that day.

What manifestly did drive the market down were the interrelated inflation issues and the Fed’s raising of interest rates in response. Somewhat disturbingly, the inflation/Fed narrative was not driven by new developments during the quarter so much as a growing realization of the implications of long known information.

Over the two years ending in January this year, the US money supply (M2) increased approximately by 41%. That is not unprecedented historically but is far outside the experience of nearly every investor alive today. (Over the 30 years 1989 to 2019, M2 grew by an average of 5.4% annually.) Mainstream macroeconomics textbooks are relatively straightforward that this increase in the money supply will likely result in inflation. Expecting consumer prices to rise by 41% is both simplistic and an exaggeration, but it is the proper order of magnitude.

In this context, the 7%+ annual inflation we have recently seen in the CPI is neither transitory nor likely to be a high watermark. From this, the Fed will have to raise short-term rates to a level considerably higher than the 2% or 3% levels currently being discussed. Generally speaking, short-term rates hover around inflation, meaning that short-term real rates are usually near zero. Meaningfully negative real rates are themselves inflationary, as they encourage borrowing that increases the money supply.

On the other hand, equity investors must keep in mind that the fixed income markets are primarily affected by inflation and rising rates. The impact on equity is secondary, and US equity is arguably the least frightening asset class. Fixed income is challenged. Non-US equity is more exposed to the war. Commodities have already rallied strongly and are much riskier now. Even cash is less attractive given high inflation.

Naturally, the benefit of this process-of-elimination endorsement of equity was not spread evenly during March’s rally, nor for the quarter as a whole. Technology, the perennial market leader, gave back -8.51%1 for the quarter, meaningfully underperforming the S&P 500. Energy, driven by war-related price surges, was the standout, gaining 39.08%.2 Less glamorously, but perhaps more sustainably, the lower volatility and dividend-focused Utilities and Real Estate sectors both gained for the quarter, up 4.77%3 and 2.49%4, respectively.

Nonetheless, the capitulation that might have been expected in the giant glamour stocks that have been leading the US equity market for the past two years did not occur in Q1 2022. Tesla gained 1.97%. Apple, Amazon, and Alphabet experienced minor losses but still outperformed the S&P. Only Microsoft, the stodgiest of the top 5 names, underperformed, losing -8.14%, roughly in line with the Technology index. Whether this is confirmation of the invincibility of these stocks or the result of the optimists’ last stand will likely be revealed soon.

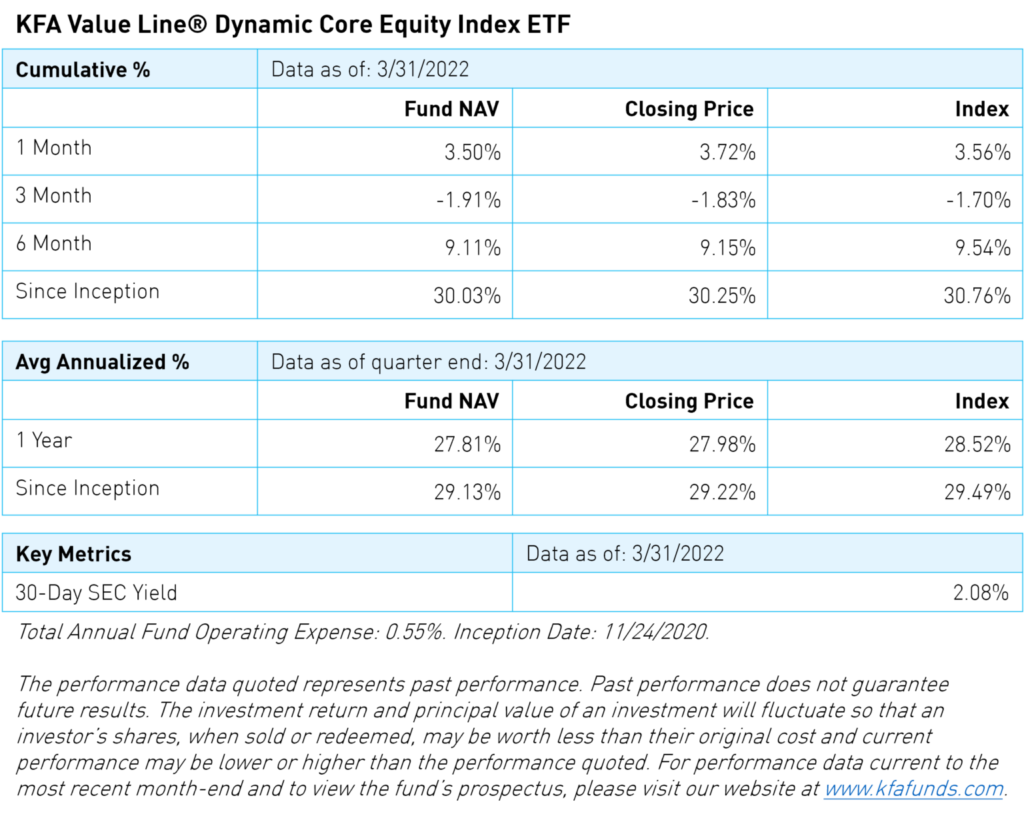

Our own KFA Value Line® Dynamic Core Equity Index ETF (Ticker: KVLE) declined by -1.81% for the quarter, 2.79% ahead of the benchmark S&P 500. For the fifteen months from the end of 2020 to March 31 of this year, KVLE gained 25.66% on a total return basis, ahead of the S&P at 22.79%.

We believe KVLE can help investors position themselves for rocky markets. Steady companies with strong balance sheets that pay healthy dividends should do well compared to the S&P 500 overall market in most times of difficulty. This is even more so in an environment characterized by reluctant equity investors, who increase US equity allocations for lack of alternatives and naturally favor the less risky stocks.

- S&P Technology Select Index, total return as of 3/31/2022.

- S&P Energy Select Index, total return as of 3/31/2022.

- S&P Utilities Select Index, total return as of 3/31/2022.

- S&P Real Estate Select Index, total return as of 3/31/2022.

Index Definition:

S&P 500: is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

r-ks-sei