The New Core: Higher Dividend Yields Without A Sector Or Style Bias

Have Your Cake & Eat It Too!

Executive Summary

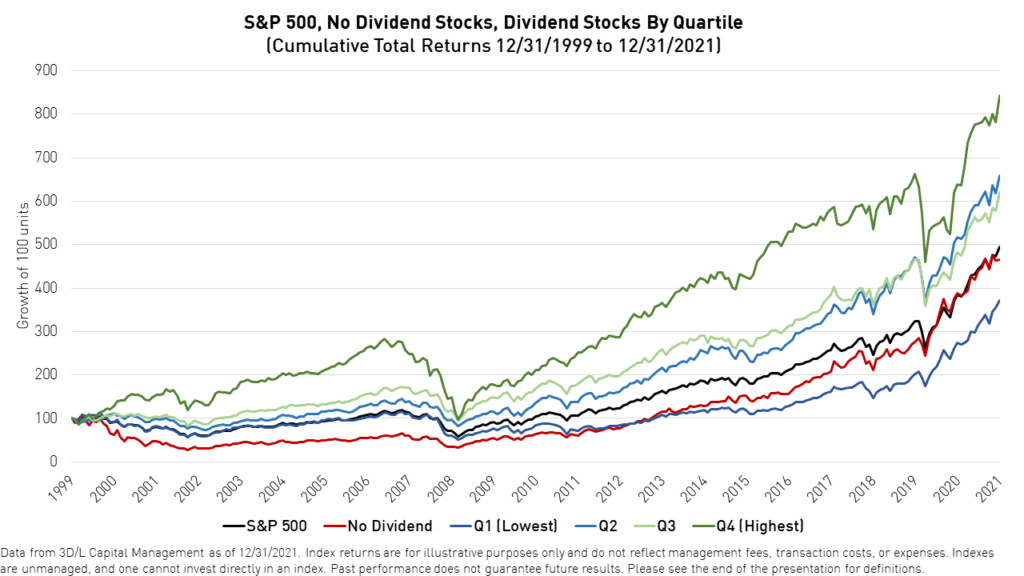

- In our view, dividend yield investors should not only hold the highest yielding names, but also avoid the lowest yielding names.

- A strategic emphasis towards high dividend yielding stocks while maintaining broad market participation may result in an improvement in risk-adjusted returns in a core US equity exposure.

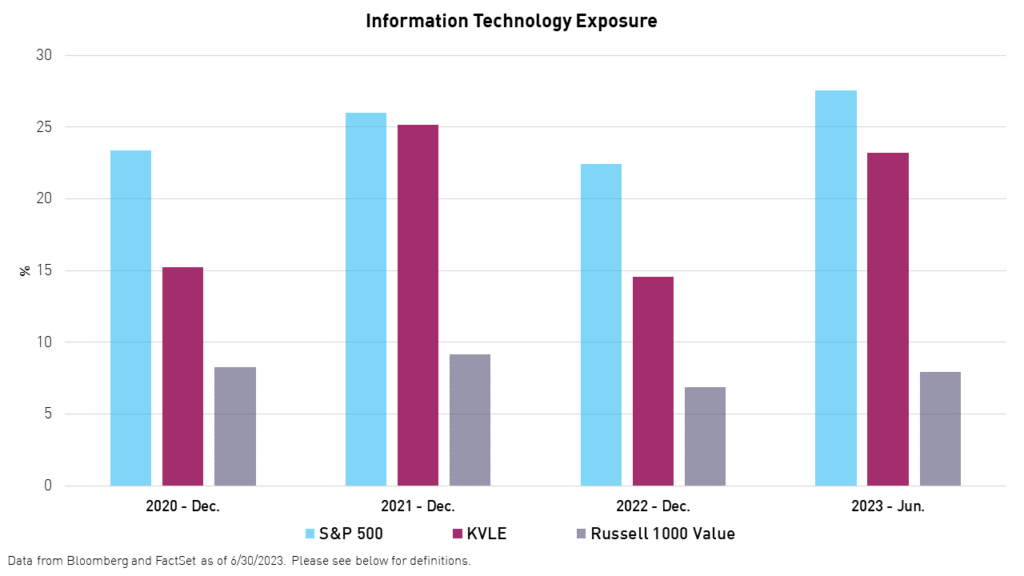

- We believe the new core is a large cap strategy tilted towards stocks with more desirable corporate fundamentals but neutral regarding style (growth vs. value) and sector exposure.

- We believe the KFA Value Line® Dynamic Core Equity Index ETF (Ticker: KVLE) is the best representation of this new core.

Introduction

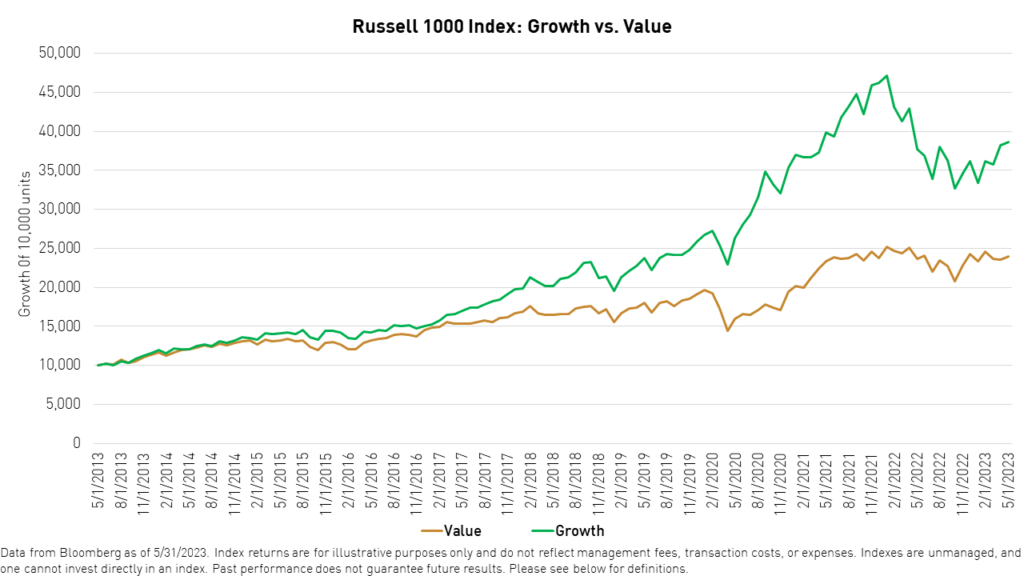

The impact of dividends on the long-term performance of the S&P 500 Index and other broad US market indices is too significant to ignore. Reinvested dividends have accounted for over 50% of the S&P 500’s total return over the past 50 years.1 However, in recent decades the index’s performance has been driven by the price appreciation of a handful of stocks that pay little to no dividend whatsoever, leaving dividend-focused and value-oriented investors on the sidelines. This has led to not only the illusion that dividends are less important, but also a dramatic increase in the concentration risk present in indexes such as the S&P that are meant to be broadly diversified. We believe that, in today' s market, a core US equity portfolio must employ a barbell approach, maintaining exposure to the growth stocks driving overall market performance alongside a ballast of high-dividend paying stocks.

Is A Value Bias Necessary To Maximize Dividend Yield?

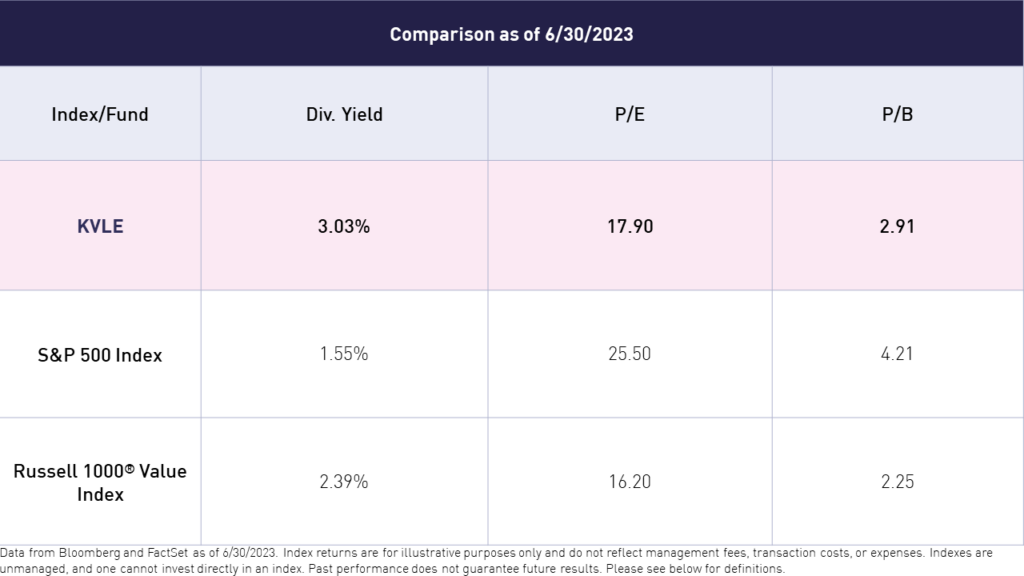

While value stocks tend to pay higher dividends, we do not believe one necessarily needs a value bias to maximize the dividend yield of a portfolio.

The reality is that there are many “value” companies that pay dividends, but low ones. Crucially, while these companies appear to be doing better than companies that pay no dividend at all, they systematically underperform.

As such, while including the highest yielding stocks in a portfolio makes sense based on historical data, including the lowest yielding stocks does not. This could provide an opportunity to round out the portfolio with the no-dividend stocks that perform in-line with the S&P 500.

Despite currently having an over 20% exposure to information technology, KVLE exhibits a higher dividend yield than the Russell 1000 Value Index, which has an exposure to information technology of less than 10%.

For KVLE 30-Day SEC Yield and Standard Performance, please click here.

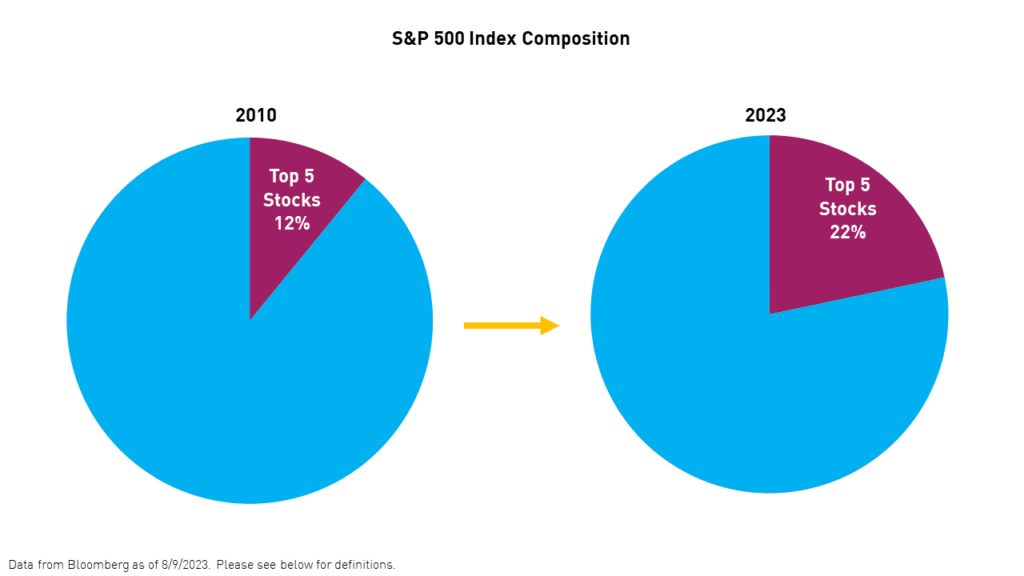

Not So Diversified Anymore

As recently as just over a decade ago, in February 2010, the five largest companies in the S&P 500 index accounted for about 12% of it. They were Exxon, T-Mobile, Microsoft, Pfizer, and Wal-Mart. Each was a dominant giant in the respective fields of energy, telecoms, computer technology, health care, and retail. As such, a portfolio of the five would have been modestly diversified.

Today, the top five are Apple, Microsoft, Amazon, Nvidia, and Alphabet. One might point out that this list is diversified, made up of a maker of cell phones, a software company, a retailer, a chipmaker, and a search engine. But, we know better. All five share a common theme. They are high-profile, technology-oriented companies with familiar consumer products and celebrity founders. A portfolio of the five would be far from diversified.

To make matters worse, the top five names account for nearly twice as much of the index as they did in 2010, when they were actually a diversified bunch.

The New Core

We believe that, in today's market, a core US equity portfolio achieves a balance between high-dividend, value stocks and high-growth stocks that do not pay dividends. Conversely, such a portfolio would avoid the stocks that pay the lowest dividends, which tend to underperform the market, and the high concentration risk present in the S&P 500. Moreover, such a portfolio would have the potential to provide an above-average overall dividend yield while participating in growth run-ups when they do occur. Essentially, allowing an investor to have their cake and eat it, too.

KVLE achieves this balance through ValueLine®'s Safety™ and Timeliness™ Ranking Systems. The Safety™ rankings ensure that the portfolio has a significant allocation to high dividend paying stocks. Meanwhile, the Timeliness™ rankings ensure the portfolio also has a sizeable allocation to stocks with price momentum and elevated earnings growth expectations.

Conclusion

Coming into this year after a challenging 2022, recession fears dominated headlines. Many investors positioned themselves conservatively and were subsequently caught off guard when growth stocks experienced an unexpected rally in the first half of 2023. Now, these same investors are faced with a difficult choice: chase the allure of growth stocks or guard against volatility.

In light of this, we believe investors should consider using the KFA Value Line® Dynamic Core Equity Index ETF (Ticker: KVLE) to replace or enhance their existing core US equity exposure. KVLE’s barbell approach maintains exposure to the growth stocks driving overall market performance alongside a ballast of high dividend paying stocks. This can help investors achieve a balance between exposure to growth and attractive quarterly distributions.

This material must be preceded or accompanied by a current prospectus. Investors should read it carefully before investing or sending money.

This should not be regarded as investment advice or a recommendation of specific securities. Holdings are subject to change. Securities mentioned do not make up the entire portfolio and, in the aggregate, may only represent a small percentage of the fund.

For KVLE top 10 holdings, risks, and other fund information, please click here.

- Data from Bloomberg as of 6/30/2023