My Take on the Markets and Volatility as the Coronavirus Continues to Spread

By Nancy Davis, Portfolio Manager for The Quadratic Interest Rate Volatility and Inflation Hedge ETF

We are living through unprecedented times. In a few short weeks, the novel coronavirus has cost thousands of lives and destroyed wealth around the world. Investors are asking the question, “what do we do now?” Are we headed for an extended depression as economic activity comes to a halt? Or are the policy responses – perhaps the largest in history – going to be effective? Is the $2 trillion fiscal spend (equivalent to 9.5% of GDP) and unbounded and limitless bond-buying enough? Is it too much? How should investors position portfolios for these volatile markets?

Investors are also worried about diversification in their portfolios. They’ve seen stocks and bonds sell off together. Parts of their portfolio may not have performed as expected. Many may wonder where they can find diversification these days.

IVOL, The Quadratic Interest Rate Volatility and Inflation Hedge ETF, just named the Best New US Fixed Income ETF of 2019 by ETF.com, may potentially help investors address these concerns.

Finding Diversification

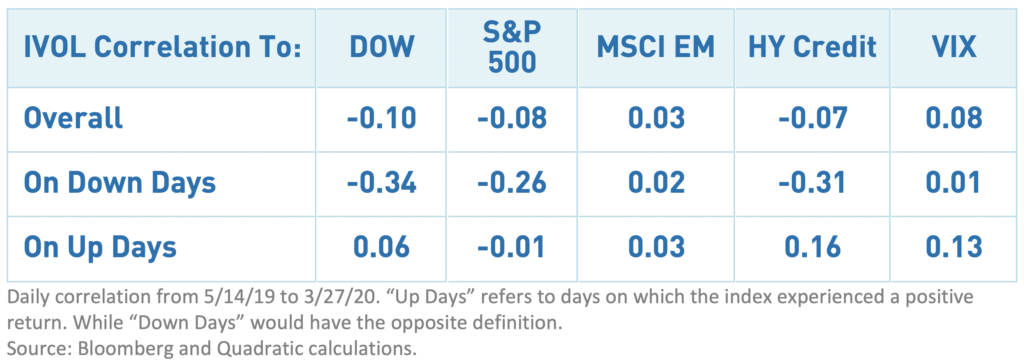

IVOL is a potentially attractive addition to a portfolio looking for diversification. It may act as a partial hedge, given how it has very low correlations, which the major indexes show below.

Interestingly, IVOL has stronger, negative correlations with major US equity indexes on days that those equity indexes fall. Historic data does not guarantee future trends, but investors worried about further sell-offs could potentially see IVOL as a possible way to benefit while also further diversifying their portfolio.

As we have seen over the past few weeks, it may be that a simple mix of stocks and bonds won’t give investors the true diversification they want to reduce the volatility of their returns. IVOL potentially may play a role in providing diversification. Of course, past performance does not guarantee that IVOL will continue to perform in this fashion in the future.

Which Way Do We Go?

There seem to be two broad schools of thought. The first sees the world economy entering a prolonged depression: consumer-oriented businesses are shut by government order - the economy begins a major contraction, and US unemployment exceeds 25%. The Fed has already taken rates to zero and is now limited only to nontraditional policy responses. Negative rates are a real possibility within this scenario. With the baby boomers entering retirement, such an outcome could be a nightmare for investors.

The second viewpoint sees the response as overblown and the economic impact of the response as potentially more damaging than the virus itself. With the US government launching a stimulus program equivalent to nearly 10% of GDP and the Fed taking rates to zero while implementing massive QE purchases, some argue that the economy will roar back once the initial stage over the virus has passed.

We wanted to draw your attention to the unique structure of the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL). IVOL seeks to hedge relative interest rate movements, whether these movements arise from falling short-term interest rates or rising long-term interest rates, and to benefit from market stress when fixed-income volatility increases while providing the potential for enhanced, inflation-protected income.

IVOL owns inflation-protected US Treasury bonds plus options on the yield curve. IVOL may help mitigate market drawdowns when short term interest rates move lower while potentially benefiting from subsequent rallies when longer-dated yields rise, and the curve steepens. Investing in IVOL is not without risk. If market volatility, and especially interest rate volatility, were to fall, IVOL might not perform well. IVOL would also be challenged if inflation were to fall even further from its current level. Another scenario that would be challenging for IVOL is if markets stayed in the current ranges or if the yield curve were to flatten further. IVOL performs best when there is movement in the prices for financial assets. We detail all the risks faced by investors in IVOL in our prospectus, which can be viewed or downloaded here.

Conclusion:

Despite all the talk about the virus, the truth is that no one knows what path it will take, how long it will last, and how severe it will be. This uncertainty is likely to continue to feed higher volatility and investors should be prepared for multiple scenarios in the coming months.

We believe that an investment in IVOL may potentially offer investors positive returns in a time when other assets are struggling, as well as a potential partial hedge for their risky assets. Investors who would like to learn more should contact their advisors and ask about IVOL or email the IVOL team at [email protected].

- Definitions

- MSCI Emerging Markets Index: The MSCI Emerging Markets Index is an index used to measure equity market performance in global emerging markets.

- S&P500: The S&P 500 is a stock market index that tracks the stocks of 500 large-cap U.S. companies.

- The Dow Jones Industrial Average (“The Dow”): An index that tracks 30 publicly-owned companies trading on the New York Stock Exchange and the NASDAQ.

- MSCI Emerging Markets (MSCI EM) Index captures large and mid-cap representation across 26 Emerging Markets (EM) countries.

- The iBoxx iShares High Yield Corporate Bond Index (HY Credit)is designed to reflect the performance of USD denominated high yield corporate debt.

- VIX: VIX is a CBOE index that represents equity volatility of 30-day expectations of the S&P 500 equity index.

- This commentary represents the manager’s opinion. It should not be considered investment or tax advice or recommendation of any specific security.