IVOL Quarterly Update

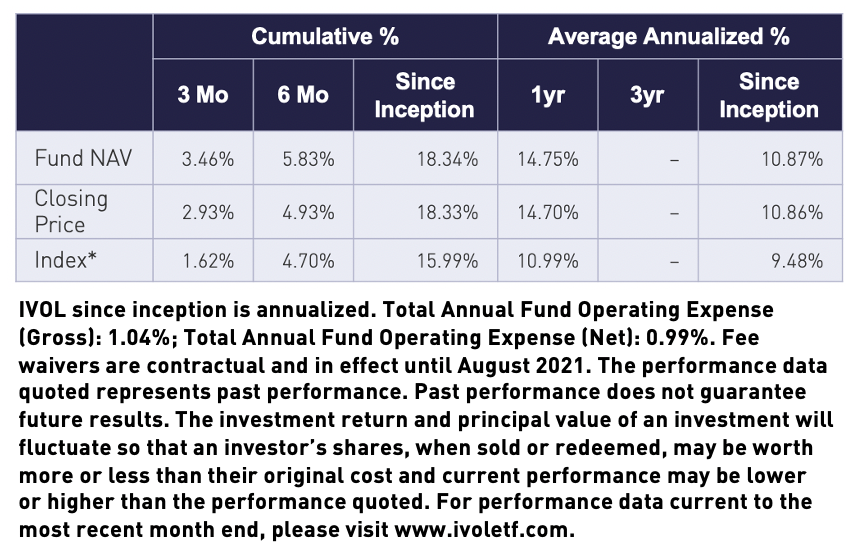

After positive performance in the first quarter of 2020, including positive performance in March 2020, IVOL continued to enjoy positive performance in each of the following quarters as markets recovered and rallied.

Additionally, IVOL has distributed a minimum of 30 bps monthly since July 2019.

IVOL Performance as of 12/31/20

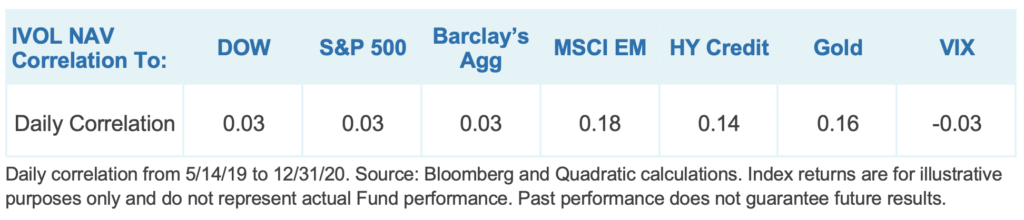

Importantly, IVOL also continued to show low correlations to many other commonly traded asset classes. Investments with low correlation coefficients are often attractive as potential diversifiers.

Few of us were sad to say goodbye to 2020. The pandemic and the attendant lockdowns have been horrific for families and businesses around the world. But the impacts have been quite disparate across economic sectors. Recent TV ads indicate that Disney is offering 35% discounts at their Florida theme park. Cruise lines are offering similar deals. But residential real estate outside the big cities is booming. UPS is telling major customers that it simply can’t carry out as many deliveries as it would like. Sony’s new “Playstation 5” sold out immediately and is now going for hundreds of dollars over retail on second-hand e-commerce sites. And the demand for puppies is so high that we are experiencing "dogflation."

Go ahead – try to find a new puppy right now!

So while some sectors of the economy are barely hanging on, there is clear upward price pressure in areas that are less dependent on in-person gathering or travel. Focused on the jobless numbers, the Federal Reserve has committed itself to being as accommodative as possible for however long it may take.

The uncertainty around the recovery and policy changes in Washington may lead to higher volatility in fixed income, which we would expect to be a positive for IVOL.

In this letter, we want to update our investors about our performance during the past year, and discuss how investors are using IVOL.

An alternative inflation measure?

Some concerned Treasury holders have been rotating into Treasury Inflation-Protected Securities (TIPS). TIPS are set using the Consumer Price Index (CPI). We understand that trade. We like TIPS, too. They form the foundation of our IVOL ETF. But we have an issue with TIPS, which is why we created IVOL.

TIPS reset their principal amounts based on CPI. CPI is a calculation performed by the US Bureau of Labor Statistics (BLS). Its single biggest component – roughly one third of the entire measure - is the cost of shelter, for which it largely uses rent as a proxy. As the BLS says on their website, CPI measures “the prices paid by urban consumers for a market basket of consumer goods and services.”1 Perhaps CPI is not the most appropriate measure of inflation for fixed income investors?

By managing a portfolio of options tied to the shape of the yield curve, IVOL gives its investors exposure to the steepness of the yield curve and thus, exposure to inflation expectations, since the yield curve is largely a result of investors' inflation expectations for the future. This is different than CPI alone. Inflation expectations which form the yield curve are not based on a basket defined by the BLS. These expectations may be more relevant to bond investors than things such as rent levels in the CPI basket.

We believe that enhancing our TIPS with options gives us both a broader and a more targeted way to own inflation expectations. Our interest rate options have the potential to increase in value with a normalization of inflation expectations that are not in the CPI basket.

What role can IVOL play in a portfolio?

We see clients using IVOL primarily for one or more of the following reasons:

Diversification: IVOL offers low correlations to most other major asset classes and may help lower the overall volatility of a portfolio. We have covered this in some detail above.

Completion: The Bloomberg Barclay’s US Aggregate Bond Index has no allocation to inflation protection. And roughly 1/3 of “the Agg” is short volatility via its mortgage exposure. Investors relying on the Agg for the totality of their bond exposure are missing a significant part of the market, and taking on exposure they may not want. IVOL may help round out an Agg allocation by providing exposure to inflation and inflation expectations, while also providing a long volatility allocation which may potentially hedge some part of the short volatility arising from the Agg.

Hedge for Equities: IVOL owns fixed income volatility and may act as a market hedge since this volatility has historically increased during large equity sell-offs.

Potential Income: Since it began paying distributions last year, IVOL has distributed at least 30 bps per month. Investors looking for income may find that number interesting, especially if their hunt for yield has taken them significantly down the credit spectrum or further out on the curve than they'd like to be.

Potential Risks

All investing involves risk, including possible loss of principal. Although diversification does not ensure a profit or guarantee against loss, the objective of a well-balanced portfolio is to help mitigate these risks with complementary assets. An informed investor should also understand IVOL’s potential risks, which we discuss further below.

There can be no assurance that the Fund will achieve its stated objectives, including its objective of eliminating the curve or inflation risk.

IVOL may underperform or lose money when the U.S. interest rate curve flattens or inverts, perhaps significantly. When this occurs the Fund’s investments may generally underperform a portfolio consisting solely of U.S. government bonds.

IVOL’s OTC options may give rise to a form of leverage, which may magnify the Fund’s potential for gain and the risk of loss. The Fund may potentially be more volatile than a portfolio of traditional investments such as stocks or bonds. These options may be subject to liquidity risk and counterparty risk.

The Fund’s use of OTC options is not intended to mitigate credit risk, or non-curve interest rate risk. Additionally, IVOL invests in debt securities, which typically decrease in value when interest rates rise.

Investing in options tied to the shape of the swap curve is considered speculative and can be extremely volatile. The Fund is non-diversified.

This has been a tough year for many. We are grateful for your trust and confidence and hope everyone enjoys a better 2021.

Ms. Davis founded Quadratic Capital in 2013. She began her career at Goldman Sachs where she spent nearly ten years, the last seven with the proprietary trading group where she rose to become the Head of Credit, Derivatives and OTC Trading. Prior to starting Quadratic, she served as a portfolio manager at Highbridge Capital Management where she managed $500 million of capital in a derivatives only portfolio. She later served in a senior executive role at AllianceBernstein.

She has been the recipient of numerous industry awards. She was named by Barron’s as one of the “100 Most Influential Women in U.S. Finance.” Institutional Investor called her a “Rising Star of Hedge Funds.” The Hedge Fund Journal tapped her as one of “Tomorrow’s Titans.”

Ms. Davis is considered a leading expert in the global financial markets and writes and speaks frequently about markets and investing. She has been published in Institutional Investor, Absolute Return and Financial News, and has contributed articles to two books.

Ms. Davis has been profiled by Forbes, and interviewed by The Economist, The Wall Street Journal, and The Financial Times among others. Ms. Davis is a frequent guest on financial television including CNBC, CNN, Sina, Fox and Bloomberg. She is a sought-after speaker for industry events.