How investors can potentially earn enhanced inflation-protected income through Fed rate cuts or hikes

The Quadratic Interest Rate Volatility and Inflation Hedge ETF seeks to hedge the risk of increased fixed-income volatility and rising inflation and to profit from rising long-term interest rates or falling short-term interest rates, often referred to as a steepening of the U.S. interest rate curve, while providing inflation-protected income.

In seeking to achieve its objective, IVOL looks to profit from relative interest rate movements, whether these movements arise through Fed rate cuts or rising long-term interest rates. Additionally, IVOL may profit during periods of market stress, as volatility increases.

IVOL’s Risk Profile

Investing involves risk, including possible loss of principal. There can be no assurance that the Fund will achieve its stated objectives, including its objective of eliminating the curve or inflation risk. Investors should take note of the following risks before investing in IVOL. A more thorough discussion of options investing can found on the Options Clearing Corporation’s websit, a link to which can be found in the disclosure footer of this webpage.

- A Flattening Yield Curve Risk: IVOL may underperform or lose money when the U.S. interest rate curve flattens or inverts, perhaps significantly. When this occurs the Fund’s investments may generally underperform a portfolio consisting solely of U.S. government bonds.

- Leverage Risk: IVOL’s OTC options may give rise to a form of leverage, which may magnify the Fund’s potential for gain and the risk of loss. The Fund may potentially be more volatile than a portfolio of traditional investments such as stocks or bonds.

- Liquidity & Counterparty Risk: OTC options may be subject to liquidity risk and counterparty risk.

- Credit & Non-Curve Interest Rate Risk: IVOL’s use of OTC options is not intended to mitigate credit risk, or non-curve interest rate risk. Additionally, IVOL invests in debt securities, which typically decrease in value when interest rates rise.

- Considered Speculative: Investing in options tied to the shape of the swap curve is considered speculative and can be extremely volatile.

- The Fund is non-diversified.

What is IVOL:

IVOL is a first-of-its-kind ETF designed to hedge the risk of an increase in fixed income volatility and/or an increase in inflation expectations. It also seeks to profit from a steepening of the yield curve, whether that occurs via rising long-term interest rates or falling short term interest rates, which are historically associated with large equity market declines. IVOL also provides the potential for enhanced inflation-protected yield.

On November 26th, IVOL declared its fifth monthly distribution of 30 bps. For comparison, the US 10 Year Treasury yields approximately 14 bps per month.

Monthly Commentary:

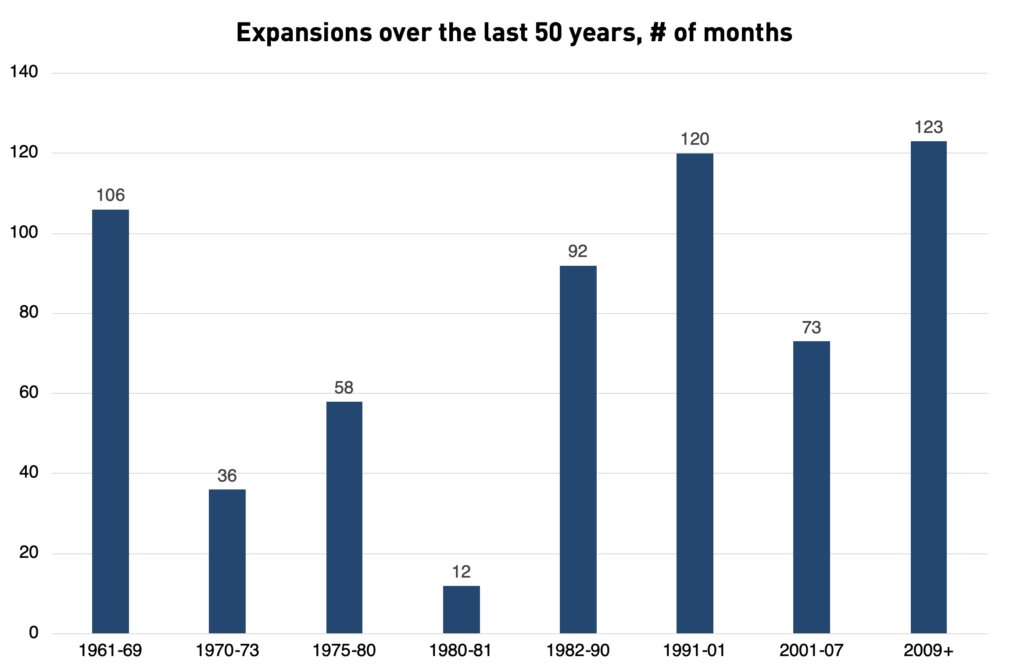

The current economic expansion – now in its 123rd month – is the longest recovery in the US since the 1960s. It is now longer than the decade-long expansion of the 1990s and has left the ’61-’69 expansion far behind. (Please see chart below.)

Source: Bloomberg as of October 15, 2019 and Quadratic Capital calculations

This expansion has reached the point where the Fed has now cut interest rates by a quarter-percentage point for the third time this year.

This expansion may continue further. If that happens, there exists the potential for inflation to take off as the economy powers on fueled by even cheaper money. Or perhaps these recent cuts are not enough and we are on the brink of another business cycle. Interestingly, IVOL has the potential to profit during both inflationary and recession scenarios.

What’s going on with the Fed?

The Fed seems to be wanting to move away from a flat yield curve. Chairman Jerome Powell said in his testimony before Congress and again during his most recent press conference that, “inflation expectations are the most important driver of actual inflation.”

Consistent with Powell’s focus on inflation expectations, the Fed now seems to be working to increase inflation expectations by steepening the yield curve with their purchase of Tbills. Their hope seems to be that they can make the curve steeper by trying to bring down short-term rates. We see these purchases as an attempt to normalize inflation expectations by returning the yield curve to its customary steepness.

Many investors may hope to protect themselves from rising inflation by using TIPS. (We count ourselves among them – see below.) But TIPS have one drawback as an inflation hedge – they are tied to the Consumer Price Index (CPI), whereas it is really inflation expectations for the future which have a stronger impact the rate sensitivity of bond portfolios. IVOL own TIPS, but we enhance our TIPS with options on the yield curve. These options are similar to options on inflation expectations, because the yield curve is largely a result of inflation expectations. As such, IVOL gives investors another way to potentially profit from inflation rather than just waiting for their TIPS to reset to current CPI.

Let’s Reverse the Twist

Let’s examine the long history of the Fed using the yield curve for monetary policy. In the original “Operation Twist” of the 1960s, U.S. policy makers attempted to shrink the gap between short and long-term yields.

In 2011, during the Eurozone debt crisis, the Fed could not reduce short term rates further as they were already at zero. As the Eurozone debt crisis raged, the Fed implemented a second “Operation Twist.” Operation twist actually reduced inflation expectations by flattening the yield curve.

The Fed now seems focused on reversing the flattening that it induced 8 years ago. Powell has been very clear that the Fed is focused on inflation expectations, and the yield curve demonstrates the market’s expectations for inflation. If the Fed is successful in pushing inflation expectations higher, we would expect that the yield curve will revert to its classic upward sloping shape. In that case, IVOL is designed to profit from a normalization of inflation expectations by owning options on the shape of the yield curve plus TIPS.

Not Enough “Insurance Cuts”?

If the Fed is not successful and we enter into a recession, IVOL offers a potential hedge against corrections in equity and real estate as the prices of equities and properties tend to fall during times of increased fixed income volatility and/or a steepening of the interest rate curve. What makes IVOL unique is that it is long interest rate volatility via its access to the OTC fixed income options market. No other active or passive ETF has provided its investors access to this market before. This access is the key to IVOL’s potential to profit from volatility whether rates are moving up or down.

In addition to inflation-protected yield, IVOL is designed to hedge the risk of an increase in fixed income volatility and/or an increase in inflation expectations by profiting from a steepening of the yield curve, whether that occurs via rising long-term interest rates or falling short term interest rates.

Why Does IVOL Own TIPS?

Some investors have asked us why IVOL owns TIPS and not regular US Treasury bonds. We wanted to explain why in this monthly commentary.

We see four reasons to own inflation expectations and TIPS now, and see them as a better buy than conventional Treasuries.

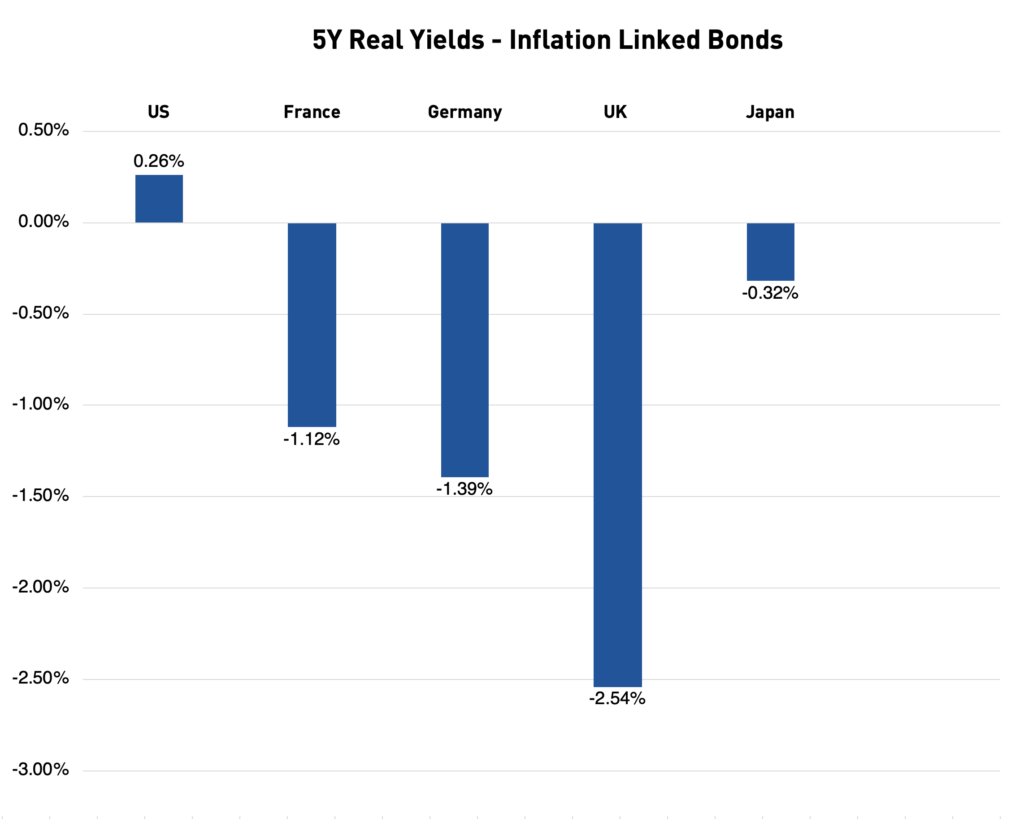

- First, US TIPS continue to have an attractive real yield when compared to other developed market inflation-linked securities. Most central banks, including the Fed, ultimately target lower real yields (above headline/nominal yields). The US is the only major economy with positive real yields.

- Second, TIPS provide more income than regular US Treasury nominal bonds. Inside IVOL, we own roughly a 7-year duration of TIPS. Also, note that the nominal 7y conventional Treasury bond has a negative real yield of -0.02% when factoring in the current 1.7% inflation rate.

| Current inflation = 1.7% |

| 7Y TIPS current yield = 1.96% |

| 7Y TIPS real yield (7y) = 0.26% |

| Current conventional 7Y Treasury yield = 1.68% |

| Current conventional 7Y Treasury real yield = -0.02% |

| Source: Bloomberg data as of as of Oct 15, 2019 and Quadratic calculations using the real yield and current CPI inflation. |

- Third, the Federal Reserve has succeeded in nearly all of its post-crisis goals, with the exception of inflation. The Fed has clearly studied Japan and has no desire to be caught in a cycle of spiraling deflation. As such, we believe the Fed is focused on inflation expectations and we don’t want to fight the Fed.

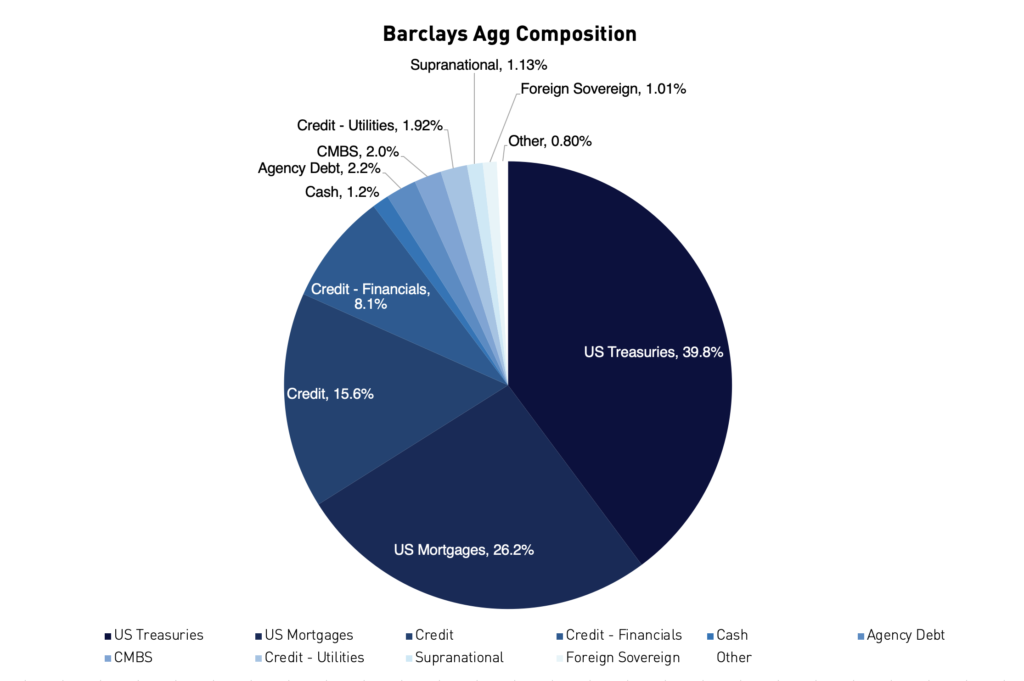

- Fourth, many investors use the Barclays Agg Index for their fixed income exposure. TIPS are not in the Barclays Agg! Many passive investors are benchmarked to the Agg, but most pension funds target a real return number. Eventually, for these reasons, we believe we should see wider adoption of TIPS as a superior product to protect purchasing power and help ensure that the boomers don’t outlive their wealth.

Where does IVOL fit?

Regarding IVOL, it may appeal to those looking for potentially enhanced inflation-protected income, and also those with concerns about a market correction. Those who expect lower short term rates or rising long term rates may wish to consider an allocation to IVOL. Please note that this fund invests in options. Option investing is not suitable for all investors. Potential investors should have the risk appetite for the potential volatility associated with options.

IVOL may act as a diversifier since investors whose portfolios closely track the Barclays Agg – or who use an ETF benchmarked to it – are very likely to be short volatility. This is because 26% of the Agg index is mortgages, and investors in mortgages are inherently short volatility! (The borrower has the option to pre-pay their mortgage at any time. This means the investor in the mortgage is short that option to prepay.) Passively using the Agg or a similarly-benchmarked fund has led a whole group of investors to be short volatility without even realizing it.

Additionally, because hundreds of billions of dollars is invested using the Agg as a benchmark, there is a risk of overconcentration. By simply buying what is in the Agg, investors are creating portfolios that look like every other bond portfolio. This may be fine as long as the bond market is steady and functioning normally. But if investors decide to sell these positions simultaneously, it could be very difficult for all sellers to liquidate what they assume is a very safe part of their portfolio. By using TIPS as a large part of the portfolio, IVOL is not forced to replicate the Agg or to invest in a “crowded trade.”

We believe that enhancing our TIPS portfolio with options gives us a way to own inflation expectations which are currently priced at a discount to realized inflation and give investors a potentially better risk/reward profile than TIPS alone.

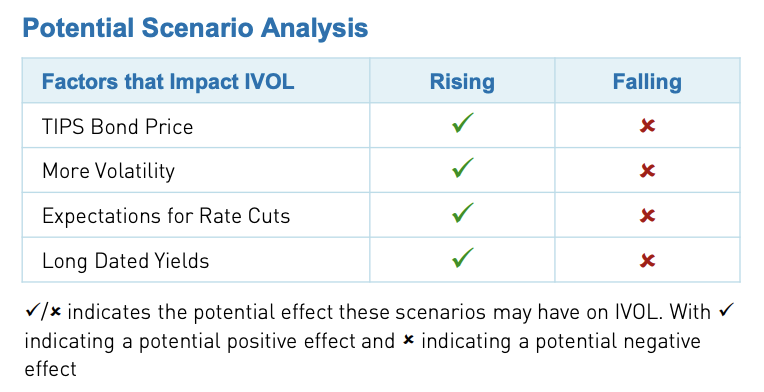

IVOL Scenario Analysis

Below are the best and worst-case scenarios for IVOL.

If you are looking for potentially enhanced inflation protected income, are concerned about a market correction or expect lower short term rates or rising long term rates, you might consider IVOL as an addition to your portfolio.

Index Definitions

The Bloomberg Barclays US Aggregate Bond Index is a broad base bond market index representing intermediate term investment grade bonds traded in the United States.

IVOL's gross expense ratio is 1.04%. The net expense ratio is 0.99%. Adviser is contractually waiving fees until August 1, 2020. The performance quoted in the commentary represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please visit our website at www.ivoletf.com.

This commentary represents the manager's opinion. It should not be regarded as investment advice or recommendation of specific securities.

The KraneShares ETFs are distributed by SEI Investments Distribution Company (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Krane Funds Advisors, LLC, the Investment Adviser for the Fund. Additional information about SIDCO is available on FINRA’s BrokerCheck. r_ks_sei