The Case For Yield: Hidden Signals From High Dividend Companies

Nathan Eigerman, co-CIO at 3D/L Capital Management, the nondiscretionary sub-advisor to the KFA Value Line® Dynamic Core Equity Index ETF (ticker: KVLE), recently released a whitepaper outlining his findings on high dividend-yielding strategies. In the paper, Nathan highlighted that beyond having a history of outperformance, stocks that payout significant dividends are attractive because they indicate several positive signals about the quality of a company.

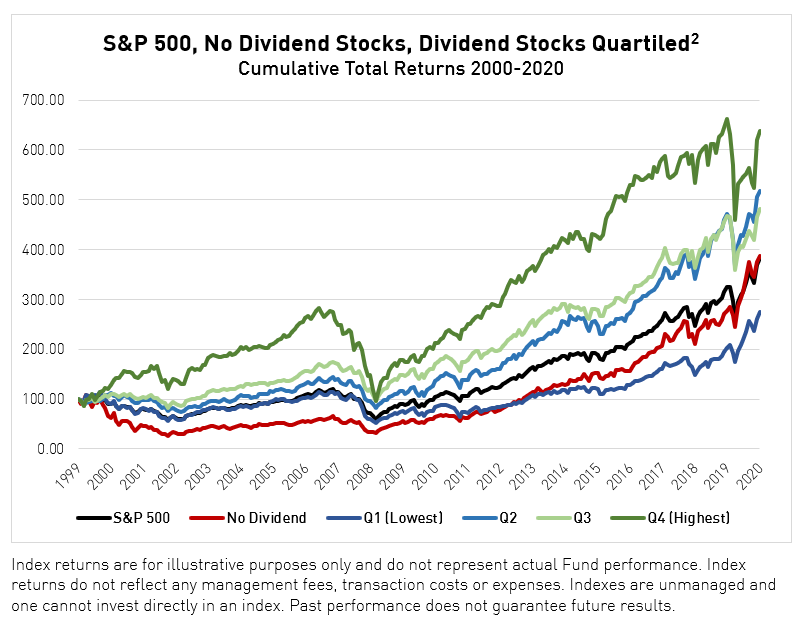

Nathan analyzed the total return of S&P 500 members since the year 2000, separating the stocks into different portfolios based on their dividend yield. The study showed that the higher-yielding portfolio meaningfully outperformed the lower-yielding one on a total return basis. Furthermore, the portfolio of approximately 250 of highest yielding stocks experienced less volatility1 than the low yielding one and the S&P 500 as a whole.

However, Nathan noted that focusing purely on the highest dividend stocks may not necessarily be the best approach. He conducted a second study that grouped the stocks into smaller baskets, again based on their dividend yield. While the highest yielding portfolio not so surprisingly posted the greatest return, it was also the most volatile.

He found that yield investing should be, therefore, less about holding a small number of the highest yielding names and instead about avoiding the small number of the lowest yielding ones. A more broadly diversified3 portfolio with an upward yield bias, such as the one in the first study of 250 highest-yielding names, still outperformed while better minimizing risk.

He concluded that irrespective of total return, there also is much to be said about the positive prospects of companies that offer high dividends. The paper details how a meaningful dividend generally reflects well on a company's long term profitability, shareholder interests, and valuation.

Intro to KVLE:

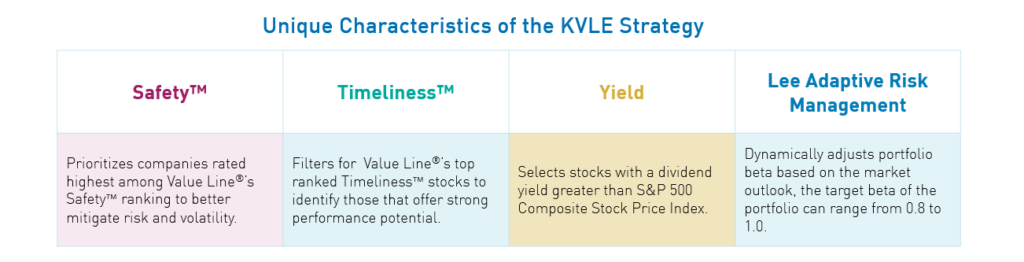

In addition to considering dividend yield, KVLE's index applies a quantitative approach that scores Value Line®’s highest-ranked Safety™ and Timeliness™ stocks based on a differentiated weighting system. 3D/L's Lee Adaptive risk management tools dynamically adjust the beta4 of the portfolio with the goal of limiting the impact of significant market declines while capturing positive returns in typical market environments.

With many dividend strategies on the market, our newly launched KFA Value Line® Dynamic Core Equity Index ETF (ticker: KVLE) incorporates a unique combination of several factors that distinguish it from its peers.

Through implementing a differentiated multi-factor approach, KVLE aims to more effectively identify quality, dividend growth companies and enhance existing smart beta strategies.

Citations:

- Volatility: is the degree of variation of a trading price series over time as measured by the standard deviation of returns. Standard deviation is a quantity calculated to measure the extent of deviation for a group as a whole. A low standard deviation indicates that the data points tend to be closer to the mean (also called the expected value) of the set, while a high standard deviation indicates that the data points are spread out over a wider range of values.

- Methodology: Each paper portfolio was rebalanced at the start of each of 252 months covering the period 12/31/1999 to 12/31/2020. Stocks were assigned to portfolios based on then current dividend yield. Stocks with no dividend were grouped together in their own basket. Portfolios were cap weighted, based on total equity capitalization at start of each month. All data sourced from FactSet. Monthly returns were calculated as the weighted average of total returns, with dividends reinvested. Stocks that were missing either dividend yield or total return in the FactSet database were excluded for that month’s calculation. (Excluded stocks averaged 0.32% of S&P 500 weight in total.) Returns include no fees or transaction costs.

- Diversification does not ensure a profit or guarantee against a loss.

- Beta: A measure of the volatility of an individual security or portfolio compared to the systematic risk of the entire market, measured by some benchmark. Beta is usually expressed as a value from -1 to 1, where -1 means the security or portfolio moves exactly inverse to the market and 1 means the security or portfolio moves precisely with the market.