About KFA Funds

KFA Funds is the premier platform for developing and delivering differentiated, high-conviction investment strategies to global investors.

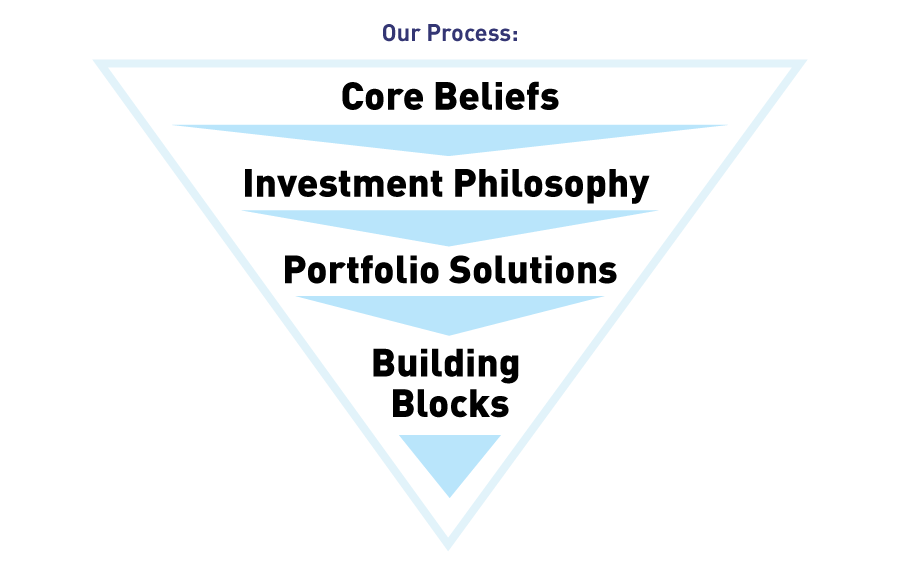

Core Beliefs

- We believe that well-designed investment portfolios should emphasize differentiated, high-conviction investment strategies and themes.

- We are an experienced team of professionals, laser focused on providing an exceptional investment experience for our clients.

- We are passionate about identifying and delivering groundbreaking capital market opportunities to investors throughout the world.

- We believe that maintaining a global perspective across a full spectrum of asset classes is crucial in driving results.

- We pride ourselves in delivering timely, best-in-class investment insights and education.

Investment Philosophy

Investors should have cost-effective and transparent tools for attaining asset class exposure. We apply our cross-asset class and systematic investing expertise to help investors obtain targeted and thematic market exposures. We seek to be a leading source of non-traditional diversification for global investors.

Portfolio Solutions

Krane Funds Advisors has launched a suite of ETFs across major asset classes and global exchanges. KFA Funds are specifically designed to deliver differentiated and non-traditional asset class exposure that can form the foundation of a comprehensive investment portfolio. These strategies are designed with the institutional investor in mind, delivering a distinguished pattern of returns that can potentially enhance portfolio performance.

Building Blocks

Our exchange traded funds provide the foundation for our process and are created based on a culmination of our core beliefs, investment philosophy and best thinking for meeting client investment objectives. We began by focusing on China and emerging markets, creating components that we believe many global investors were missing from their portfolios. We have since extended our philosophy and applied it to US investment categories in order to produce differentiated, high conviction equity and fixed income strategies for institutional investors.