KMLM: Trends and Turns in Bonds for Q2

Index and Sector Performance

The KFA MLM Index, which is tracked by the Mount Lucas Managed Futures Index Strategy ETF (Ticker: KMLM), finished the quarter down 2.4%. Commodity (-3.2%) and Global Fixed Income (-1.2%) markets detracted from performance while Currency (+0.8%) markets contributed to results. Interest income added 134bps. For the twelve months ending June 2024, the Index was down 3.6%. Year to date, the Index is up 1.5%.

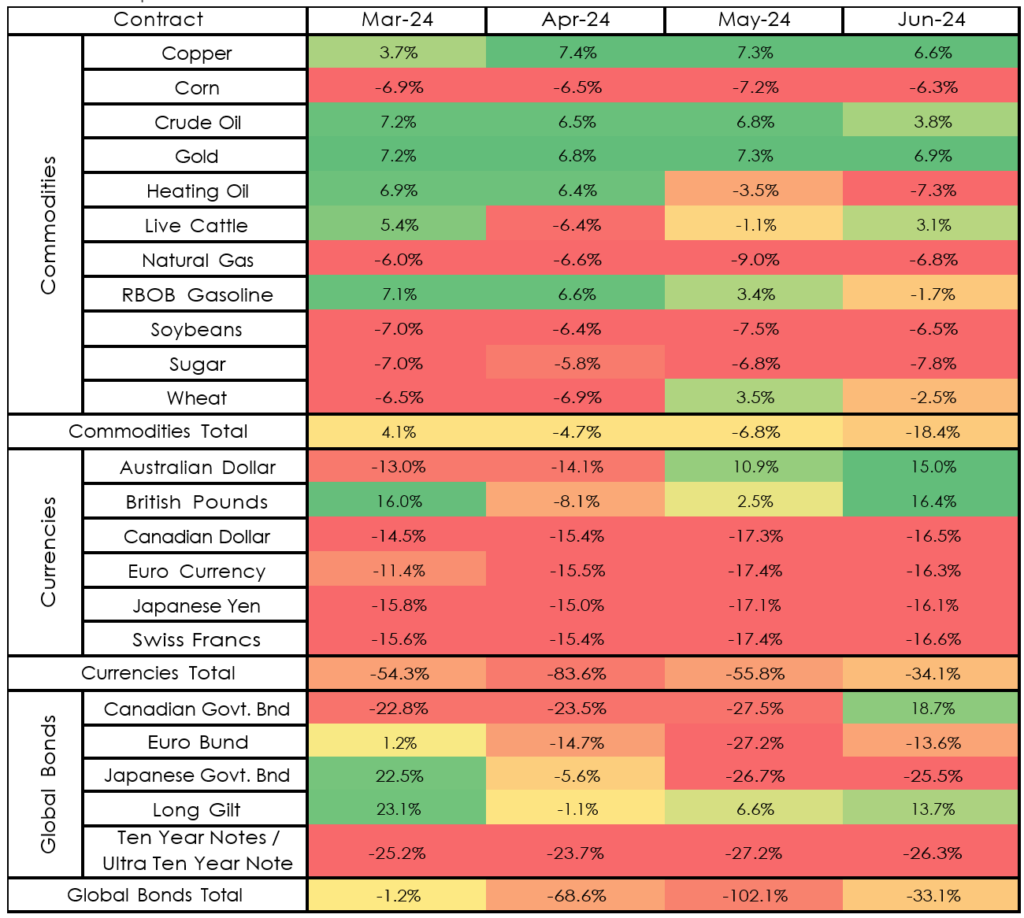

Index and Sector Exposures

Over the course of the quarter Commodity exposures went from net long 4% to net short 18%, Currency exposures went from net short 54% to net short 34%, and Global Fixed Income exposures went from net short 1% to net short 33%.

Outlook

The bond market continues to oscillate between pricing in interest rate cuts, both in the U.S. and abroad, and then pricing them back out again. We have seen several cycles of this in the first half of 2024, with the second quarter ending economic data starting to point toward easing conditions. This cycle has also affected currency prices and outside of Japanese Yen (whose trend has outlasted several interventions), not many markets are trending well. The Index’s longer-term lookback has been beneficial at limiting whip saws, most notably in the U.S. Ten Year market that keeps rallying to the one year moving average then selling off. On the commodity side, markets seem to be decoupled from macro Fed watching, but generally tame, even as we enter the summer growing season in grains. Copper and Gold price moves have been the most newsworthy. The world needs a lot of Copper as it attempts to electrify, and there just isn’t enough supply on the way. One market that keeps trending up on low volatility, Equities.

In the Commodity sector, the top 3 contributors were Corn, Copper, and Soybeans. The bottom 3 detractors were short Wheat, Natural Gas, and Unleaded Gas. In the grain markets, the short positions Corn, Soybeans, and Wheat all finished near their lows for the quarter. Wheat did see a sharp price rally early in the quarter, drawing the Index into a long position, before selling off into the end of June at new lows, with the Index returning to a short position. In metals, the Index entered the quarter long and that paid off as Copper rallied aggressively through mid-May on supply concerns. While prices did sell off from their highs, still a profitable position. Gold finished a bit higher on the quarter, but largely range bound around 2400. In energy, Natural Gas rallied off its lows into early June, before selling off toward the low end of its range. Crude Oil, Heating Oil, and Unleaded Gas mirrored the Natural Gas move, with prices falling into early June before rallying at month-end. In agricultural, Sugar was down on the quarter, but well off lows at the end of May. Live Cattle prices climbed aggressively after a small sell-off in early April, finishing the quarter at recent highs. The major shifts in exposure during the quarter came in Copper (increased long), Crude Oil (decreased long), Heating Oil (long to short), Live Cattle (long to short to long), Unleaded Gas (long to short), and Wheat (decreased short).

In the Currency sector, the top contributor was short Japanese Yen, and the top detractors were British Pound and Australian Dollar. Most currency markets saw similar price moves during the quarter, selling off versus the Dollar in April, before rallying into early June, then selling off a bit toward the end. The Canadian Dollar was largely range bound near the lower end. Despite and intervention here in there that rallied the Japanese Yen for a day or two, it was pretty much straight down for the currency, benefitting the Index short position. The major shifts in exposure during the quarter came in Australian Dollar (short to long), British Pound (long to flat to long), and Euro Currency (increased short).

In the Global Fixed Income sector, the short position in Ultra Ten Year was the only contributor with UK Long Gilt and Canadian Government Bonds the top detractors. Bond prices were largely range bound during the quarter, bouncing between pricing in rate cuts to pricing them back out again. The major shifts in exposure during the quarter came in the Canadian Government Bond (short to long), Euro Bund (flat to short), Japanese Government Bonds (long to short), and Long Gilt (long to flat to long).

Net Market Exposures

Holdings are subject to change.

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index returns do not reflect management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.